#BizTrends2023: How to win in sub-Saharan Africa's retailing landscape

The situation was particularly challenging for countries like Ghana, where a depletion in foreign currency reserves led to the Cedis depreciating by over 50% against the US dollar, contributing to a 44% rise in food inflation by September 2022.

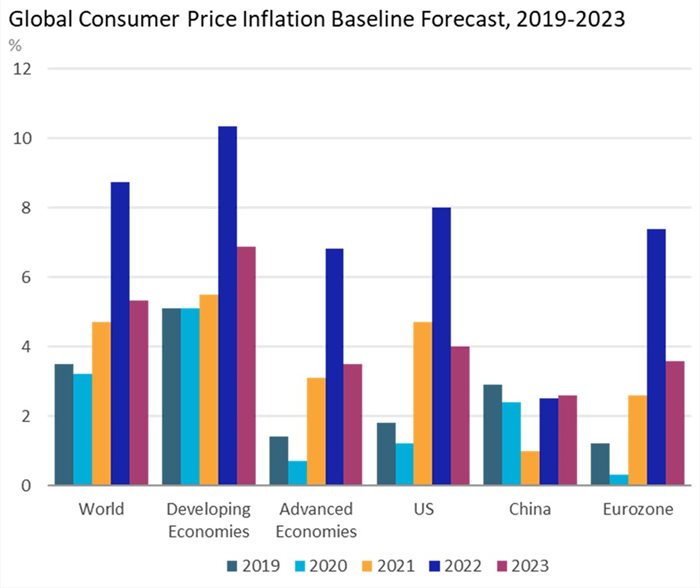

According to Euromonitor International’s economic forecast models, developing markets like sub-Saharan Africa will continue experiencing relatively high inflationary pressure in 2023. Subsequently, having a viable operating strategy is essential to remain competitive across the regional retailing landscape.

Differentiate through diversified and unique offerings

With loyalty becoming a scarce commodity at the back of rising interest rates and shrinking disposable incomes, retailers will have to diversify their offerings through innovation and added-value services.Under the circumstances, partnerships with leading operators across telecommunications, banks or government entities will help consolidate shoppers’ interest.

A noticeable example can be taken from South Africa, with Shoprite introducing banking services and Pick n Pay allowing shoppers to renew their vehicle licence discs in-store.

On the other hand, leveraging insights from loyalty programmes and shoppers' consumption patterns to develop targeted promotional campaigns or bundling will be key in growing outlets traffics. Moreover, showing more commitment toward local sourcing, circular economy, and communities can strengthen profitability and brand equity.

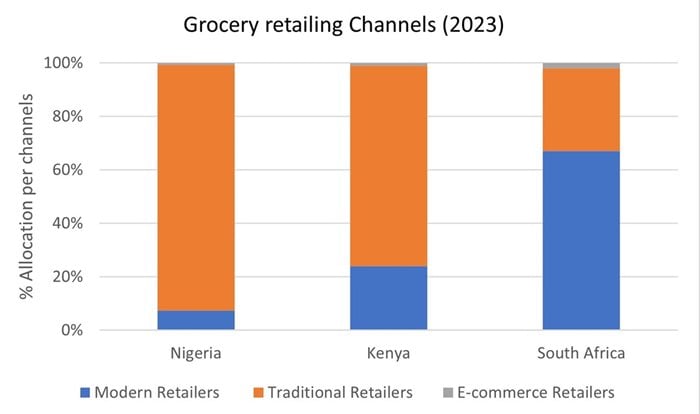

Be aware of traditional and informal retailers

With regional retailers like Massmart divesting from East and West Africa, local operators like Markets Square in Nigeria are given room to expand their activities.

Nevertheless, traditional and informal retailers will remain the ultimate competitors for any modern grocery retailers.

Such a dominance will continue to be driven by core value propositions like proximity to households and, more importantly, in 2023, affordability of customised smaller packaging sizes and shoppers' bargaining powers.

The channel will also benefit from the rapid expansion of fintech, empowering traders by bridging the supply chain gap and giving them access to digital financial services like micro-loans and insurance services.

As relationships between African startups and global impact-focused investors strengthen while the African Continental Free Trade Area (AfCFTA) agreement shapes, such operators will remain key contributors to a modernised traditional retailing landscape across the region.

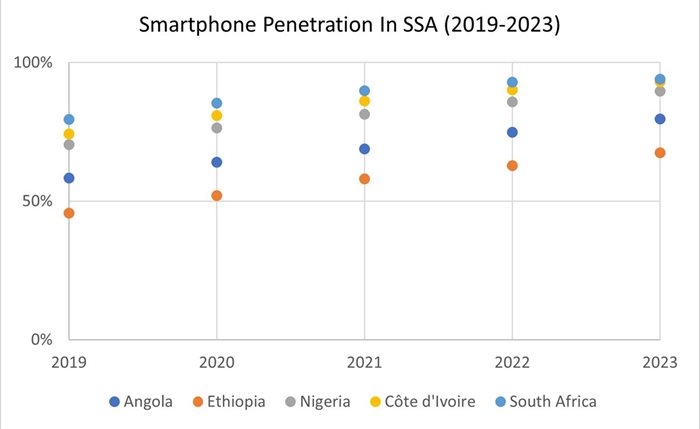

Find the balance in the 'phygital'

With more emerging markets like Africa accessing the internet, 60% of global consumers are expected to be connected in 2023, doubling the penetration rate during the latest global economic recession (2008-2009).

The rising level of connectivity also implies that more will use online search engines for price discovery, intensifying competition for pure-play e-commerce.

In parallel, omnichannel operators might need to find the balance to avoid channel cannibalisation, mitigate incremental costs from online activities, and expand their consumer bases. As a result, improving consumers’ experiences through curated content, streamlined apps, and gamification might allow retailers to remain ahead of their competitors.

Along the same line, implementing a sound visual and social commerce strategy across platforms like TikTok will likely boost engagement and increase brand awareness. Moreover, creating synergy by coopeting with marketplaces can reduce fulfilment costs, while collaborating with third-party delivery services should help meet demand from impulse shoppers efficiently.

The sub-Saharan African market will continue offering myriad opportunities to businesses capable of grasping the profound social and economic divides. Therefore, strategic positioning should meet the expectations of a complex consumer base ranging from middle- and high-income aspirational shoppers following global trends, the household shopping from traditional and informal traders, or the rising tech-savvy and Afrocentric generation Z.