Source: Supplied

Prashaen Reddy, a partner at management consulting firm Kearney says that this is thanks to the explosive growth of young, urban, and digitally savvy consumers; increasing mobile phone penetration; the creation of digital payment and shopping networks; favourable governmental regulations and spending initiatives; and significant investment by both foreign and domestic companies.

In the most stable times, retailers expanding their global footprint face a series of difficult decisions. Yet in the wake of Covid-19, together, these forces are transforming the face of African retailing and providing a blueprint for the development of other emerging markets, seeing Morocco, Egypt and Ghana making the top 10.

Source: Supplied

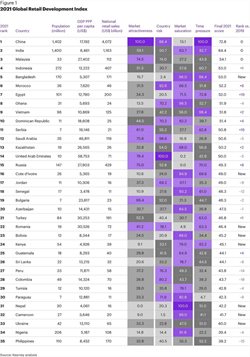

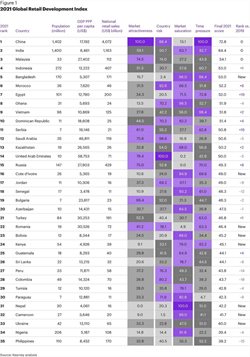

click to enlargeDetermining which markets are growing, attractive, and relatively risk-free is one of the goals of Kearney’s GRDI which ranks 35 emerging countries based on a set of 26 factors, including four key variables: country risk, market attractiveness, market saturation, and sales growth.

Questions GRDI asked were, should retail enter new markets? Expand their operations in emerging nations that may or may not be yielding returns, or cut their losses?

How to evaluate the comparative potential of modern retailing in nations still dominated by informal or traditional vendors?

These are some of the questions the Global Retail Development Index (GRDI), which tracks selected emerging retail markets, was created to answer. (See graph to the left.)

Population, disposable income growth

Reddy adds, “The global population is expected to increase by 2 billion by 2050, and Africa will be home to the majority of these new lives. The population of sub-Saharan Africa (SSA) alone is expected to double by 2050, with Nigeria expected to be the third-largest country in the world.”

This is one of the reasons we will see the growth in Asia begin to slow down and Africa emerge as the next big retail hotspot. It’s also predicted SSA will enjoy the highest rate of disposable income growth on Earth, about 9% CAGR.

There are four classes of SSA retail – informal, traditional, modern, and illicit – with modern retailing dominated by regional players, primarily South African operators, such as Shoprite, Mr Price, and Pick n Pay, and a few international players.

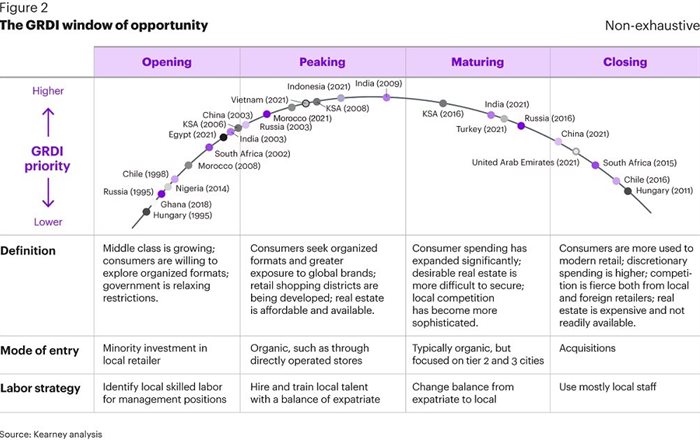

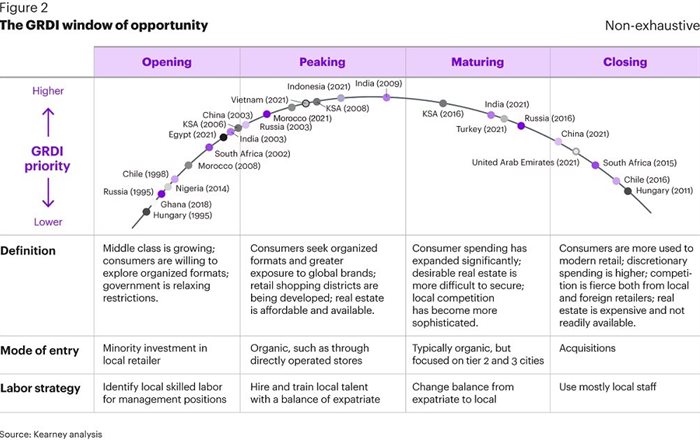

With South Africa not making the top 30, we need to look at the where and why South Africa fits into the closing bracket within the GRDI property scale of window of opportunities. This means consumers are used to more modern retail, the discretionary spending is higher and there is a fierce competition from both local and foreign retailers. This closing segment is where investments are ripe for acquisitions.

Focus for African retailers

In the face of increasing competition and margin pressures, Africa’s retailers are focusing on ROI; adopting franchising and other new business models; and rationalising store footprints following the lead of Massmart, which recently announced it would be closing the 8% of its stores that were underperforming which includes plans to double down on African countries, focusing on price, private label, and building customer loyalty.

“The main challenges are corruption, widespread poverty, security concerns, supply chain issues, lack of infrastructure, active conflicts, archaic governmental retail policies and practices, and isolation, which are as real as the potential. At 18%, for example, SSA has the lowest rate of intra-regional trade on the planet,” says Reddy.

Retailers and central banks in various countries are working toward developing and facilitating digital ecosystems by reducing transaction costs on electronic payments, but gaps in e-payment infrastructure supply, logistical inefficiencies, and trust issues are slowing down both existing and future growth opportunities, with Africa accounting for about 50% in mobile money transactions globally.

Top takeaways from the 2021 GRDI report

In crucial markets like Latin America, the Middle East, and Africa who are fossil fuel-dependent governments are increasingly turning to retail to diversify their economies and wean them away from oil dependency.

It’s vital to remember that emerging nations can simultaneously occupy multiple positions on the window of opportunity chart (as seen in the report). There is a significant difference between urban and rural China and India, so much so that we are well-advised to think of them as not one market but two or three.

Source: Supplied

click to enlargeUnderstanding consumer attitudes, situations, and dynamics is the basis of all retail success and the world’s consumer spending centre of gravity is slowly shifting from the US and developed European markets to emerging markets in Asia, Africa, and the Middle East. This won’t happen overnight but at least that seems to be where the arc of commercial history seems to be bending.

The pace of this development is directly linked to the innovation, penetration, and acceptance of consumer and retail technologies, from simple mobile phone connectivity to sophisticated and secure electronic payment systems.

Reddy concludes by saying “that the real lesson is that all things, especially markets, change – often, as in the case of Covid-19, with little or no warning. So, there is no effective substitute for contemporaneous in-market knowledge.”