South Africa's m-commerce up 35%, Nigeria is Africa's biggest e-commerce market, and Kenya primed for massive growth

Multiple factors have combined to bring African countries to an e-commerce adoption tipping point, creating more opportunities than ever for online and omnichannel merchants. This is particularly true for merchants in fashion, beauty, education and digital goods, according to online payment service provider PayU, the fintech and e-payments business of Prosus.

This evolution has seen the emergence of more digitally savvy shoppers with strong demand for globally sourced goods and services in regions where parts of the population have access to increasing disposable income. These factors make Nigeria, Kenya and South Africa particularly interesting for emerging e-commerce leaders from outside these markets.

Fast-growing consumer sectors

These are the key findings in a new report published by PayU titled 'The Next Frontier: the most promising markets for emerging e-commerce leaders in 2021 and beyond'. The report highlights unprecedented consumer spending growth in e-commerce in high-growth markets that have often been overlooked before 2020 in favour of more traditional Western markets.

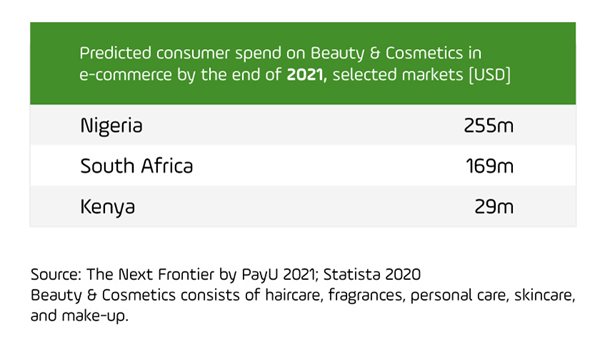

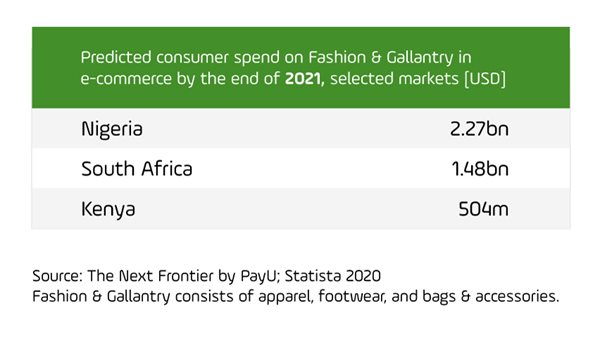

PayU conducted data analysis in 19 countries – including South Africa, Kenya and Nigeria – across five continents on four of the fastest-growing consumer sectors where PayU sees the biggest growth potential over coming years: Beauty and Cosmetics (haircare, fragrances, personal care, skincare and make-up); Digital Goods (digital music, video on demand platforms, streaming platforms, video and audio-conferencing platforms, and e-publishing); Fashion and Gallantry (apparel, footwear and bags and accessories), and Education (online courses, professional educational services, school publishing, and school and universities fees).

Ecommerce potential in Africa

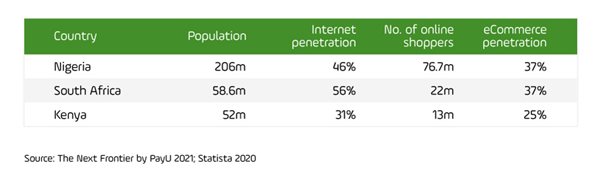

Among the three African countries included in the report, South Africa has the highest internet penetration at 56%, with Nigeria and Kenya at 46% and 31% respectively. However, e-commerce penetration is at 37% in both Nigeria and South Africa, and at 25% in Kenya. This highlights significant potential for growth in e-commerce in these markets.

The data reveals that Nigeria is by far the largest e-commerce market on the African continent in terms of the number of shoppers and revenue, with predicted consumer spend via this channel expected to be several times those of South Africa and Kenya combined.

However, Kenya is primed for a boom in e-commerce, with the digital goods sector forecast to expand by 94% from 2019 levels by the end of 2021, and the fashion and gallantry sector expected to grow by a massive 160% over the same time.

In South Africa, the market is embracing digitalisation and e-commerce, and there are abundant opportunities across every sector, but particularly for specialist merchants in beauty and cosmetics, and fashion and gallantry.

“2020 was a year that lit a fire beneath online payments in South Africa, transforming e-commerce while creating immense economic pressure,” says Karen Nadasen, CEO of PayU South Africa.

“There is growing attention on our continent, increased investment from large international brands and payment platforms. Retailers adapted quickly over the last year, and despite early bans on non-essential purchases, we saw significant growth in e-commerce, with more and more transactions being completed on mobile devices – up 35% on 2019 levels in South Africa as an example.”

According to PayU data, year-on-year online spend in beauty and cosmetics category in South Africa grew by 140% between 2019 and 2020. Spending particularly ramped up in Q3 2020, increasing by 229% compared to the same period in 2019, and is expected to grow by 69% to $169m by the end of 2021. In Nigeria, it’s expected to grow to $255m by the end of this year, and to $29m in Kenya in the same time frame.

South African consumer spend on fashion and gallantry through PayU’s platform rose by 180% between 2019 and 2020, with the average transaction value increasing by $11. In Nigeria, spend in this sector is expected to grow to $2.27bn by the end of 2021, while in Kenya it’s expected to reach $504m – a projected 160% increase comparing to 2019 results.

E-commerce spending on digital goods in South Africa is projected to grow by 46% between 2019 and the end of 2021, reaching $336m in total spend. This has been bolstered significantly by strong growth of 69% in 2020, with people consuming more digital media while spending time at home. In Nigeria, this sector is expected to grow to $811m by the end of 2021, and to $70m in Kenya – it’s a 94% increase on both markets comparing to 2019 results.

Online spend on education boomed across South Africa in 2020 as people sought to upskill themselves during a prolonged time at home. PayU data shows a year-on-year increase in spending of 67% in 2020, with the average transaction value growing by $136 to $404. The majority of the growth was in Q3 2020, when spending rose by 134%.