Africa's moment is virtually here. With a GDP growth averaging 5%, it's no wonder that Africa has become a focus for investment. All eyes are on Africa's rapidly emerging middle class - a group expected to drive consumption on the rising continent. It is therefore no surprise that so much data and stories are being churned out on Africa's middle class. Some of the data are inconsistent and at times even conflicting.

As Bright S. Simons points out in an article titled 'Beware of Africa Middle Class' time-pressed investors may find the information coming out of Africa, on the continent's middle class, confusing and frustrating.

Read existing data perceptively

Let's face it. Africa is not yet renowned for consistent, reliable statistics. But then also remember that secondary data has its own inherent weaknesses that are not peculiar to Africa. The opportunity offered by Africa's rising middle class is a reality. Interested and committed investors just have to sift through the existing data perceptively and perhaps even adopt Churchill's instincts to data from other sources - "I only believe in statistics that I doctored myself".

Caution is a big watchword when dealing with secondary data. Rarely will existing data play to all the investor's unique needs - and therefore conducting an own primary research is usually unavoidable.

The pertinent questions that most investors want answered are: Who is Africa's middle class? What attitudes and cultural values drive its behaviour? What is the size of this key class and how is it distributed across the continent? Investors need to properly determine the quality of information they use to address the above questions.

Data consistency and credibility

In evaluating the quality of estimates on Africa's middle class, investors need not only consider the expertise and credibility of the secondary data sources but also the consistency of the numbers coming from different authorities.

Questions to be borne in mind when appraising the data are: What is the technical competence of the data source? And how well resourced is the source? At least two or more size estimates from different sources should align if the existing data is to be considered sound. Where the data is misaligned - then the basis of the disparity need to be established.

A number of analysts and commentators have weighed in on the size of Africa's middle class. The African Development Bank (AfDB) estimates Africa's middle class at 355 million. It characterises the segment as those spending between $2 and $20 per day. The bank's estimate includes a marginal sub-class, which spends $2 to $4 per day. This is a floating class that could easily slip back into poverty. If this unstable sub-class is excluded from the bank's headcount then its size estimate drops to 125 million. A figure consistent with the 120 million middle class consumers projected by the Standard Chartered Bank regional head of research for Africa.

In a presentation to the 2013 Pan African Media Research Organisation (PAMRO) Conference, Andrea Rademeyer (from a South African based research agency) quoted the African middle class at 400 million - a forecast not far from the AfDB's overall estimate of 355 million.

Going back to the issue of data consistency - it can be seen that there are no apparent controversies among the above data sources. They are largely in agreement in their estimates. And in terms of credibility, both the AfDB and the Standard Chartered Bank are highly respected financial institutions within Africa and beyond. The two work and do business across Africa - and are therefore hands-on with issues on the continent.

Different yardsticks

Where size estimates from one data source differs considerably from other sources, investors should try and establish the context in which the sources are making their predictions before dismissing anyone of them for inaccuracy. For instance, Duncan Clarke of Global Pacific (a management advisory group) is obviously not using the same yardstick as the AfDB when claiming that "at a global middle-class income standard, less than 5% or 50 million Africans qualify to be called middle class".

The same can be said of the Organisation of Economic Cooperation and Development (OECD) which quotes Africa's middle class at 32 million or 2% of the continent's population. The OECD is using the $10 to $100 daily-expenditure benchmark which is much higher than the $2 to $20 per day advocated by the AfDB. The AfDB deems the OECD benchmark too high and inappropriate for Africa -given the low standard of living on the continent.

The most divergent view is held by the Citi Group's Economist for Africa. An African middle class does not exist - according to this Citi Group official. The growing consumption observed on the continent is fueled by an African elite that is getting richer and a burgeoning low-income earner segment.

Data collection method used

The method of data collection used has significant impact on the quality of the ultimate research output. Investors need to take note of this. An online search on the African middle class shows that the majority of reports that tend to pop-up first are those compiled by third parties. Third parties publish reports based secondary data. This data can be from principal sources or from other third parties. While information from third party reports is usually well summarised and more readable - it can be highly filtered and opinionated.

Lack of completeness is also a big issue with these reports. The African continent is vast and regionally and culturally diversified. And some analysts and commentators tend to take an aspect happening in one or two parts of Africa and project it as it were fact across the continent. So investors need to tread very, very carefully when working with published data.

Always go to the original source of the data to verify the accuracy of the data collection and classification used. Differences in classification can present headaches. Controversies surrounding the qualitative definition of Africa's middle class by analysts and commentators can be traced back to the complexities in classifying Africa's broadly varied geographic and cultural groupings.

Mahajan, who coined 'Africa Rising' describes the African middle class as salaried workers and small business people. The salaried workers comprise nurses, teachers and civil servants-all highly educated. This view is also held by the AfDB and Deloitte. But then the AfDB's definition also includes cattle ranchers and side-road vendors - which excluded from the Deloitte definition.

Deloitte says that Africa's middle class tend not to derive its income from farming and rural income activities and goes on to add that the segment is largely urban based and own houses equipped with modern amenities and appliances.

Members of this segment have fewer children and want their children to attend the best schools. Ownership of automobiles and mobile handsets has grown with the increasing standard of living. Africa is the biggest importer of Japanese used cars with Kenya having upstaged Russia and Chile as an importer of Japanese used cars in 2009.

Simons' definition of the African middle class somewhat contradicts that from other sources. He describes the African middle class as generally lowly educated merchants who buy goods from centers like Dubai and the Far East for trade on the continent. Vendors who help these merchants in the distribution of the imported goods are said to be also part of the middle class.

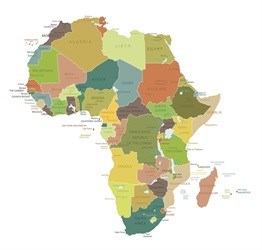

The North African countries of Morocco, Tunisia and Egypt have got the largest concentration of the middle class population. Other countries with high percentages of the middle class include Gabon, Botswana, Namibia, Ghana, Cape Verde, Kenya and South Africa.

Conduct an own research

Ultimately, investors have to conduct their own researches not only to validate current premonitions on Africa's middle class but also to inform their own go-to-market strategies. Using specialised qualitative and quantitative research techniques associated with the measurement of social class and culture, key social class differentiators can be identified, and cultural insights and trends discerned.

One important dynamic to note when investigating the potential of Africa's middle class is that Africa is not one big homogeneous market. The continent is geographically and culturally highly fragmented with a host of countries developing at varying speeds. Neighbouring countries can nonetheless share a set of cultural values but this does not mean a copy and paste of business strategies from one country to another is always a viable approach.

The other dynamic to consider is that the social class of an individual cannot aptly be adjudged by a single socio-economic measure - especially in an African context. Here, socio-economic factors like educational attainment, occupation or income can be significantly uncorrelated. It can be folly to 'size up an African brother or sister' from his last grade in school. Take the 'Black Diamonds' of South Africa for example - whose mobility into middle class was aided by a political dispensation. Quite a number of them have become extremely wealthy but are not necessarily that educated.

Use of Living Standard Measures

It can never be overemphasised that a single variable index may not reflect the complex nature of the African social class make-up. A composite variable measurement approach is required. This is the approach taken by the World Bank and PAMRO in surveying households in Africa. A composite variable index called 'Living Standard Measures' (LSMs) is used in the classification of households by both of these organisations.

The PAMRO LSMs use access to services, ownership of durables and residential location as determinants of an individual's wellbeing. These indexes are relative to a country and are not standardised across the continent. South Africa Advertising Research Foundation (SAARF) has ten LSM groups, (10) being the highest and (1) the lowest. The South African middle class is said to fall within LSM 5-7 grouping.

In fact if PAMRO (which SAARF is founding member) is to live up to its tagline, 'Your Gateway into Africa...' then the organisation needs to be weighing in more on debates regarding Africa's middle class and the potential offered by the continent in general. Its involvement will undoubtedly add credence to the existing data. After all, the organisation now has a membership network nearly covering the continent.

The problem with the data on Africa's middle class is not its paucity. A data explosion on the issue is in fact envisaged as the continent's fortunes increase. Secondary data can however be misleading - especially from a highly fragmented market like Africa. Investors have to carefully appraise the existing data from the continent for reliability and validity prior to its adoption.