Kenya's August 9 presidential elections saw a shift in political leadership, but whether the results will stand up in court remains to be seen. Nonetheless, the incoming government will be faced with multiple challenges such as rising national debt, accelerated inflation, and a relatively high unemployment rate.

Source: Supplied. Thabo Mofokeng, the insights analyst at DataEQ.

With that said, consumers appear to be feeling the pinch and are seeking financial relief through affordable banking options. This is according to the Kenyan Banking Sentiment Index – a new study carried out by Deloitte in collaboration with DataEQ.

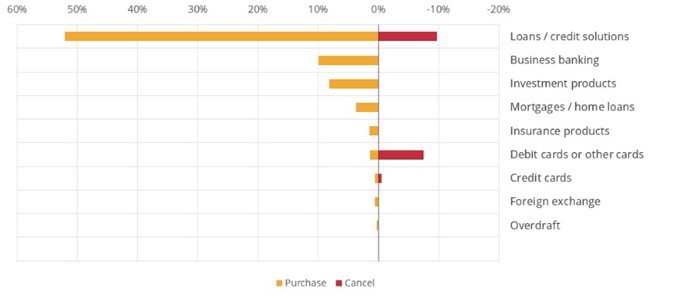

The study benchmarked consumer sentiment on social media towards major Kenyan banks – which showed that more than 50% of banking acquisition opportunities in 2021 were about loans.

Source: Supplied.

Authors on social media were prolific in comparing loan options and expressing interest in applying for short-term credit facilities. Consumers openly compared banks' interest rates against one another, with some major banks faring better than others.

Another theme that emerged in the data was consumers claiming that there were hidden fees and costs associated with loans.

Source: Supplied.

Furthermore, the ease of accessing loans and banking facilities was the key driver of pricing conversation.

Diamond Trust Bank and Co-operative Bank scored positively in terms of pricing net sentiment as consumers were enticed by zero monthly-fee accounts, prepaid student cards that do not incur extra charges, and discounts. This speaks to the price sensitivity among consumers who are battling with the rising cost of living.

Increasing competition from micro-lenders and digital banks

This increased consumer appetite for credit presents an opportunity for micro-lenders, digital banks, and mobile money providers to tap into Kenya’s unbanked market by offering seamless and innovative ways of acquiring loans.

These alternative options may offer financial inclusion for local small businesses that have no access to banking facilities.

While national pressure rests largely on incoming government to implement policies that stimulate economic growth, consumers will turn to banks to become more agile around their pricing models.

This is especially pertinent for loans where increasing consumer scrutiny is evident. Traditional banks need to compete with digital disruptor banks and lenders to retain their market share and expand their reach into the unbanked market.

This means that affordability and access will remain a critical success factor in retaining and acquiring new clients.

![By PMO - Ethiopia - [1], Public Domain,](https://biz-file.com/c/2509/787241-300x156.jpg?5)