The latest UCT Marketing Institute research study into South Africa's most influential consumer base - the affluent 'Upper Middle Class', is one of the most important for marketers in the last few years as it shows dramatic shifts in consumption habits and consumer values.

Image source: Gallo/Getty.

The most significant are the shift from wanting aspirational brands towards inspirational brands; the desire for authenticity; the prioritising of investments for the future and planning for a bond-free, debt-free lifestyle; as well as family values. This consumer has grown up.

The Top Million research report into South Africa’s "Upper Middle Class" households in 2019 was released by the UCT Marketing Institute and ad agency M&C Saatchi Abel, in both Johannesburg and Cape Town this week. These are the South African consumers with a combined spending power of R700 billion, making up almost 40% of all consumer spend, who pay half of all personal tax, and are somewhat recession proof, making up 5% of total households.

They earn R40 000 to R75 000 per month per household and now comprise the affluent segment of South Africa’s middle class, the ‘Upper Middle Class’, they are influencers and have the biggest impact on brands – they can make or break you.

Cutbacks

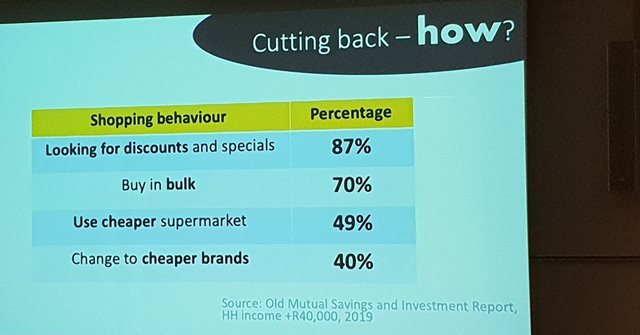

This affluent segment of the middle class has proved themselves to be fairly recession proof during South Africa’s economic downturn, but they are not without financial worries and appreciate value from brands as much as anyone; and are also hit hard by increases in public and private tax, as well as “black tax”. As a result, many are downgrading services such as medical aids, dropping out of private schools, and moving to more cost-effective web streaming services like Netflix for entertainment.

Martin Neethling, currently director of groceries at Pioneer Foods and a research associate at the UCT Institute for Strategic Marketing, who presented the overview of the research to marketers in both Johannesburg and Cape Town, this week, said that 60% of respondents in the Top Million research indicated that so-called ‘black tax’ affected them and that it was a priority to give back and support their families who had supported them. “I was an investment, I am a return now,” one respondent told researchers.

Dali Tembo, managing director at Instant Grass International went deeper into the research, presenting the segment on the financial wellbeing of the Top Million. 51% actually reported being better off this year, than two years ago, making them somewhat “recession proof”. However, the current tough economic conditions have definitely had an impact on their bank balances.

“Many of them are still living like they’re in a recession. They are also driven by future fear. They are conservative in their spending and cognisant of managing their financial investments to cater for projected tough times – driven by past experience.”

Spending habits

Tembo said these high net worth individuals knew the price of everything and would not be taken advantage of. They also used their rewards and loyalty schemes and were loyal to brands that gave them value and something back to retain them as loyal customers.

Only 5% say they are struggling to manage their debt; and they have access to credit for financial shocks. The percentage of women being the main earners is also on the rise and generally, the over 40s are happy where they are, financially and with their lifestyle. They prize time spent with family, over time spent away from them, working to get richer.

They want to live bond-free and seek out financial advisors to help them understand investments and “edit their lives” accordingly. 90% own a property and 26% own more than one property. They also make their assets work for them – renting out cottages or holiday homes.

While the research shows that some of this group have cut back on private schooling, DStv and gone for a cheaper medical aid, these are the non-discretionary items that are of vital importance to this group, no matter what happens:

- Model C or private schools

- Cars

- Medical aid

- Security

- Data, communications

- Gifts.

Their shopping habits are influenced by the fact that they have a car and are free to travel, with over 95% visiting both large and small shopping centres in the last three months, even though “mall fatigue” has also been documented. This group love shopping at independent stores and “boutique shopping” is becoming a thing, as it’s more intimate, and they like to buy direct from a supplier.

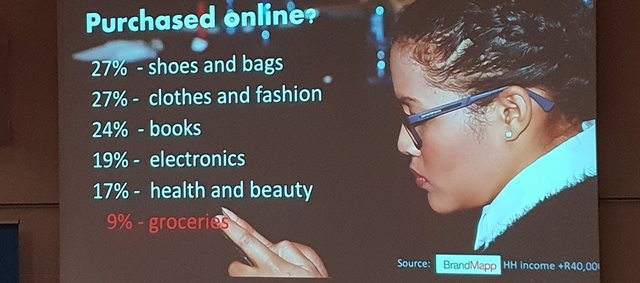

“They desire seamless experiences. Everyone loves Woolies because they love the consistency of the branding. So, while Woolworths have brand equity, the majority of people shop at Pick n Pay (23% compared to 18% at Woolies; Spar and Checkers 15%). Digital has changed the customer journey, as they are researching products and prices online before buying,” explained Tembo.

Lifestyle and wellbeing are also invested in:

- 63% have visited a gym.

- 50% have undertaken physical activity in past month.

- 33% are on a specific diet.

- 75% say they eat at a restaurant at least once a month.

- They want to travel to enable them to spend time with family and broaden experiences. They also want to participate in immersive experiences and meet new people or contribute to various cultures and get close up and personal.

- They also want to learn something – cooking or photography, etc, while travelling.

- They are digital natives and don’t visit banks much anymore – 70% have not visited a bank branch in the last three months.

- 24% watch Netflix.

- 49% watch YouTube at least once a week.

- 71% have purchased something online in the last three months.

Marketing

The last session unpacking the research this week, was delivered by Makosha Maja-Rasethaba, strategy head at M&C Saatchi Abel, who looked at how marketers can approach this digital-savvy group that understands exactly when they are being marketed to and often doesn’t feel that marketers are actually speaking to their own culture and needs.

She explained: “They know what you are doing. This is a discerning audience whose ability to block out marketing messages is high. They identify themselves as brands. They understand behavioural economics and advertising and marketing. This is a sophisticated audience. They are aware of being watched online. They use adblockers and don’t like advertising as it bombards their personal space. They have huge trust issues.

“Many spoke of not being into branding, playing into that “unbrandable me” trend. But there is tension, as there is still a huge aspiration towards luxury goods. There is no compromise on skin care, baby items and other necessities.”

Maja-Rasethaba added that the Top Million are also hybrid consumers who don’t want to be taken advantage of. “Marketers have lost the plot with the African market – they make a huge mistake by assuming everyone wants a flashy Rolex… people evolve. Marketers are still stuck in the notion of the Black Diamond driven by status. This is not the current reality.

“The reality is: inconspicuous consumption. This tough economic climate makes people more careful with spending, plus they feel guilty. This idea of austerity is also about social awareness.”

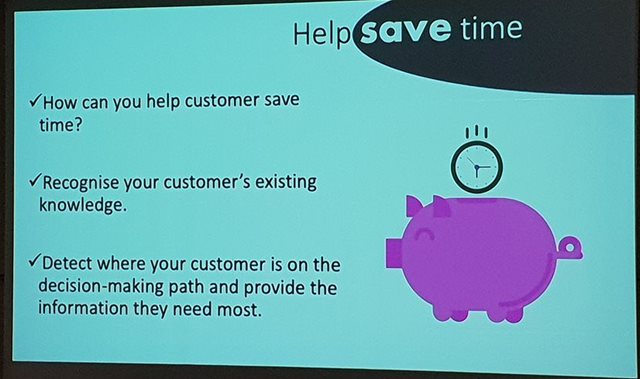

They are modern value seekers and the brands that are winning in this space, like Capitec, Woolworths, Sorbet and Uber, are those who redefine quality and either alleviate the financial pressure they are feeling, or elevate their lives, said Maja-Rasethaba.

The research shows a definite shift from aspiration to inspirational brands. Consumers want to share value with a brand, not status.

So how do marketer’s meet the expectations of the Upper Middle Class? Maja-Rasethaba outlines the key takeaways:

- Quality is key – including online; durability is important and there is a huge desire for authenticity. “Bring a story to the table. What story is your brand telling? Heritage is a special ingredient.”

- Don’t over complicate – consumers are living complex lives and they want simplicity.

- Know your brand touchpoints well to engage with the consumer. The blended retail experience is what is most successful right now: phygital, where the physical and digital stores recreate experiences that marry offline and online.

- Be ahead of the shifts: “For a long time in SA, consumers are driving trends, when we as brands should be driving the trends.

- The future is female – women are more empowered through owning their own businesses and earning well to drive the self-purchase trend, giving them access to diverse categories in the luxury market, food and beverages.

“The thing is, people don’t want to be sold anything anymore,” Makosha Maja-Rasethaba said. “They want to feel part of something. They want to buy into a lifestyle or community. Cultural currency is important. Advocacy is important as well. Successful brands can grow business organically, by advocating for social and cultural values.”