Top stories

All this is about to change over the next three years as the number of broadband subscribers is set to triple. Operators are about to start to market the service to individual consumers and begin to offer Triple Play bundles, a service offering voice, Internet and television and film programming for a single price below the overall price of buying three separate services.

A number of factors are driving this shift in how the Internet in Africa will be sold to consumers. By the middle of next year, considerably cheaper international fibre prices will come to East Africa and their impact will spread out across the continent starting in South Africa. New fibre projects will compete with the monopoly-controlled SAT3 that already connects West Africa to the world. Cheaper International prices will mean downward pressure on national backbone prices.

It will be impossible for operators to maintain high national wholesale rates alongside much cheaper international rates over much greater distances. An increasing number of African countries are legalising VoIP which allows the delivery of IP voice services over broadband. Increased competition in the Pay TV market is opening up access to TV and film programming rights for operators. All this lays the foundation for much faster retail broadband services and the possibility of delivering genuine Triple Play bundles in Africa.

This week sees the publication of the second edition of African Broadband, Triple Play and Converged Markets (the first edition was in 2005), a comprehensive 155+ page report that contains both consumer and industry data covering the key issues that will emerge as broadband growth takes off. The consumer data covers key questions from national and urban samples in 24 countries from both the high and low-growth markets.

The new Triple Play bundles will be targeted at Africa's middle classes in their homes and from the consumer survey data in the report, it is clear that a small but growing proportion of Africans have access to PCs at home.

According to one of the report's author's, Balancing Act's CEO Russell Southwood, "In terms of communications technologies, Africa is increasingly becoming a two-track continent. There are the countries where a combination of policy, regulation and investment are producing fast-track changes of which faster, cheaper broadband and Triple Play are one result. And there are those slow-track countries where the attitudes of Government, regulators and operators are shutting out investment in newer technologies like broadband.”

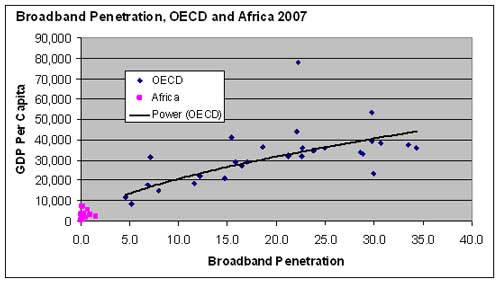

For as the chart below shows, broadband penetration in Africa is lower than what would be expected based on GDP per capita. One explanation of this pattern is that broadband services were simply launched much earlier in OECD countries, and African countries are further behind on the take-up curve.

However, as the one of the report's authors, Southwood notes that, "The impact of affordability is magnified further when average incomes are taken into consideration. The chart below shows comparative data between African countries and OECD countries. For OECD countries, the cost of ADSL as a percentage of average monthly income varied between 0.95% (Luxembourg) and both Mexico and Turkey (5.18%). For African countries the cost of ADSL as a percentage of average monthly income varied between 4.2% (South Africa), and 517.2% (Niger)”.

Consumer data in the report from countries with higher numbers of broadband users show that once a relatively cheap and much faster service is available, users make more use of the Internet on a daily basis. They also shift from checking their e-mail and looking at a limited number of web sites to doing things like listening to radio over the Internet and downloading films and music.

Alongside these changes in behaviour, it is also becoming clear that the Internet in Africa - particularly again in countries with relatively higher levels of broadband penetration - is becoming a media that is beginning to compete for African consumers' attention along with newspapers, radio and television. African newspapers, which are small circulation and expensive to produce, charge disproportionately high advertising rates and some may become vulnerable to advertising competition from the Internet over the next three years.

Details of the report are available at http://www.balancingact-africa.com/publications.html

The OECD defines “broadband” as being capable of a download speed of at least 256 Kbps . It also defines broadband technologies as DSL, cable, fibre, or ‘other'. This definition excludes these wireline services where the line is not used for Internet connectivity (such as for leased lines). The ‘other' criteria includes a range of fixed wireless broadband services, including satellite, LMDS, MMDS, and WiMAX, but excludes 3G mobile technologies and Wi-Fi. However, this report does cover all forms of mobile broadband.

Balancing Act's Broadband, Triple Play and Converged Markets, is over 155 pages long and has 42 charts, 38 tables of statistical data and 1 graphic map. In addition, there are is a spreadsheet workbook with 10 worksheets providing actuals and forecasts of broadband numbers and a spreadsheet of broadband pricing and offers from 38 countries.

The report is broken down into four sections:

Section one looks at the arrival of African Triple Play offers and the factors that will influence their take-up by consumers. It looks at which types of players are likely to want to get into the market and the kind of offers that might be possible in the African context.

Section two is based on a survey of 38 countries and examines: the different price bands being charged; mobile Internet pricing, overall subscriber numbers; and the relationship between price and subscriber numbers;

Finally, it examines the underlying factors affecting retail pricing including national and international wholesale prices, the shift from satellite to fibre and increasing investment in broadband capable national networks.

Section three examines the question of content, looking at the Internet as a media in terms of who's using it and what they use it for. It provides detailed information on 17 countries categorised as Top, Mid and Low Tier Markets.

Section four maps the roll-out of broadband deployments in the following categories and identifies the new deployments since Balancing Act's last report was published: ADSL; Fixed wireless (CDMA, Wi-Fi and Wi-MAX); Other wireless (VSAT); Cable and powerline and Mobile (2.5G, 3G, HSPDA and others).

In addition, there are a number of charts and tables listed below and two spreadsheet appendices: appendix A: Deployment of Broadband Access in Africa (2008) and appendix B: Pricing and subscriber numbers survey for broadband products in Africa (2008). The latter contains 12 worksheets whose topics and content are listed above.