“The double impact of rampant inflation and the 4.25 percentage point increase in the prime lending rate over the past 18 months has eaten into disposable income. With this economic shift in mind, Hallmark days like Mother’s Day are the perfect opportunity to help brands revive and grow as consumers are feeling the pinch,” says Steve Burnstone, CEO at Eighty20.

The lipstick effect is a consumer behavioural theory that when faced with an economic crisis consumers will be more willing to buy less costly luxury goods. For example, if consumers can’t afford a nice holiday or a new car, a luxury branded fragrance may be the next best aspirational thing to help them feel confident every morning. Across key players in the beauty industry, the lipstick effect is alive and well for cash-strapped South Africans, says Burnstone.

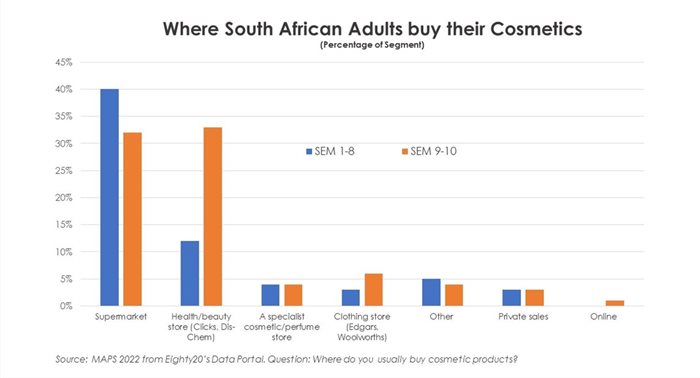

“When we review the gender split of purchasing, 65% of all South African women and a surprising 62% of all South African men purchase cosmetics such as make-up, skincare products and lotions, including perfumes or colognes. While nearly 70% of these men purchase their items (92% of which is lotion) at the supermarket, women are more likely to buy from a health and beauty store, specialist cosmetic or perfume store, or via private sales,” adds Burnstone.

“This week, stores around South Africa will experience an increase in fragrance sales and should see a double-digit uptick over the Mother’s Day period. The week leading up to Mother’s Day can make up to 70% of the total fragrance gifting sales opportunity, with personalised gifting currently a big trend for Gen Z and Millennial shoppers,” says Amanda Graham, COO of luxury beauty destination Arc.

“During Covid, make-up took the biggest hit, skincare was the strongest category and fragrance held its own. Fragrances are the most popular Mother’s Day category as it is easier to buy as a gift than cosmetics and skincare and are also often the entry point into a luxury brand,” says Maria Lambros, CEO of Prestige Cosmetics Group, distributor of luxury brands such as Chanel, Bvlgari and Dolce & Gabbana.

“Beauty sales are up around 10% on last year, but consumers will continue to be looking for value this Mother’s Day, with fragrance gift sets being in high demand. Mother’s Day is the second most important calendar event for the industry outside of Christmas, with women fragrances being the biggest category,” adds Lambros.

Meanwhile, skincare at the Clicks Group has continued to achieve double-digit growth over the last three years. Customers are becoming more educated on the benefits of skincare regimes. They are also more aware of ingredients, their benefits and key beauty trends. During the pandemic, skincare peaked, both locally and internationally with customers increasingly seeing the value in having a natural, healthy glow.

“Fragrances are a desirable item in that it has a feel-good factor. Customers are buying into their favourite brands by opting for smaller sizes or promotional offers and are also buying into spritzer and celebrity-owned brands,” says Shawn Whiffler, commercial executive at the Clicks Group.

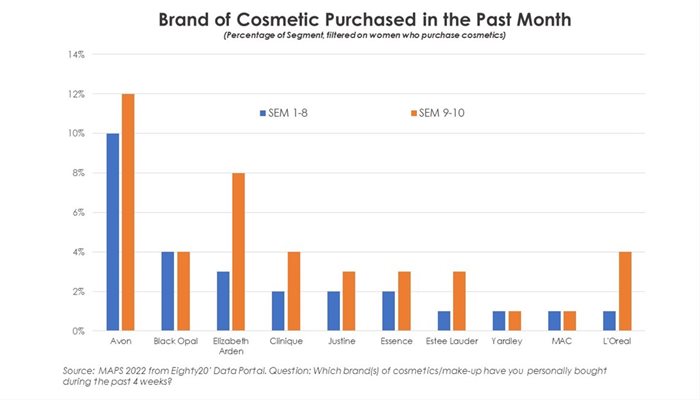

According to MAPS, available on the Eighty20 Data Portal, consumers in SEM 9-10 (who represent the top 15% of earners in the country) rank Avon, Elizabeth Arden, Clinique and L’Oréal as their favourite brands. While less wealthy consumers in SEM 1-8 in addition to Avon, have a strong brand affiliation with Black Opal and Justine.

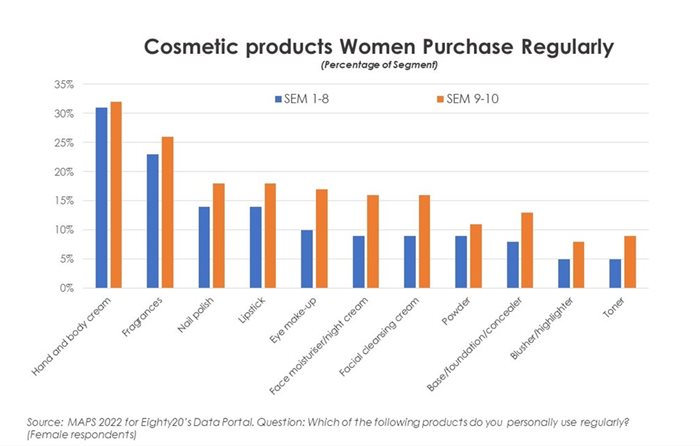

When looking at what cosmetics women buy, hand and body lotions are top, followed by fragrances, nail polish and then lipstick. Other products such as eye make-up also perform well amongst South Africa’s wealthy (SEM 9 – 10), while these more specialist cosmetics have a much lower penetration among consumers in SEM 1-8.

“As with all retail, not only must brands understand the buying patterns and preferences of different customer segments, but also how these preferences and shopping journeys change in tough economic times or during key promotional periods. If done well, this should be good news or at least a pleasant aroma for cosmetics retailers this Mother’s Day,” concludes Burnstone.