Like when using any professional service, there is a cost involved when investing your money. By investing and/or using an adviser, you pay for the knowledge and guidance you'll receive, but are you getting a fair deal for what you are paying for? The first step in answering this question is to understand the fees you are being charged.

When you invest, there is a certain amount of administration that the investment house has to do. This includes carrying out your investment instructions and providing you with investment statements. Administration fees are often charged on a sliding scale: the larger your portfolio, the lower your fee becomes. Administration fees typically range from about 0.096% per annum (excluding VAT) to 1.25% per annum (excluding VAT).

These are the fees paid to your financial adviser, who may charge on a consultation basis (a fee normally charged upfront); or on an ongoing basis for the management of your portfolio. In most instances, advisers prefer an ongoing basis so that they can oversee your portfolio over the lifetime of your investments. As a guideline you should be wary of advisers charging more than 1.5% per annum (excluding VAT) on ongoing advice fees.

Asset management companies charge fees to manage the unit trusts you invest in; and different managers charge different fees. The easiest way to compare management fees is to have a look at the fund fact sheet on the unit trusts you are interested in, which will tell you the Total Expense Ratio (TER) of a unit trust. The TER expresses the cost of investing as a percentage of the amount invested in the unit trust. Fund fact sheets are readily available on asset managers' websites.

To give you an idea of what these fees might be, below is a table on the average TERs of different types of unit trusts:

| Type of Fund | Average TER |

|---|---|

| Balanced Funds | 2.01% |

| General Equity Funds | 1.60% |

| Income Funds | 1.31% |

| Low Equity Funds | 2.07% |

Source: ASISA (excluding Institutional Class Funds)

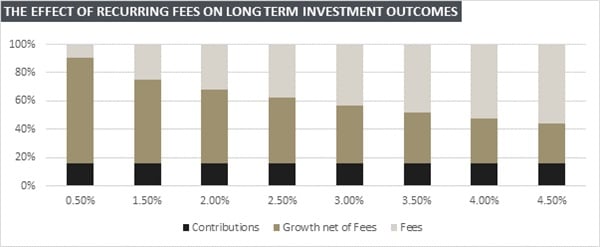

Together (and assuming your adviser charges an ongoing advice fee), these three fees add up to your annual recurring fee. Just as investment returns compound over time, so does the effect of fees. It is therefore wise to ensure that the fees you pay are competitive. This is highlighted in the table below, which shows how higher ongoing fees detract from investment returns over time, in this case 35 years.

As can be seen, recurring fees have a significant effect over long periods of time on investment performance. And while a difference of 1% might not sound like a lot, over time it can result in a significant amount. In this example, an investor paying a 2% recurring annual fee relative to an investor paying a 3% recurring annual fee will have R2.2 million or 20% more in his/her portfolio at the end of the 35 years.

Fees are a fact of life and should be looked at in terms of the value one gets from the service you receive. Taking all the factors into account when choosing a particular investment or financial professional, be sure you understand and compare the fees you'll be charged. It could save you a lot of money in the long run.

*The table assumes a monthly investment amount of R1000 with an annual escalation of 10% and an average compound annual growth rate of 13.5%. The investor pays an average administration fee of 0.30% p.a., an advice fee of 0.75% p.a. and invests in unit trusts with an average TER of 1.60% p.a. This means that total investment fees amount to 2.65% p.a.