Understanding growth power in sub-Saharan Africa and defining Africa's middle class

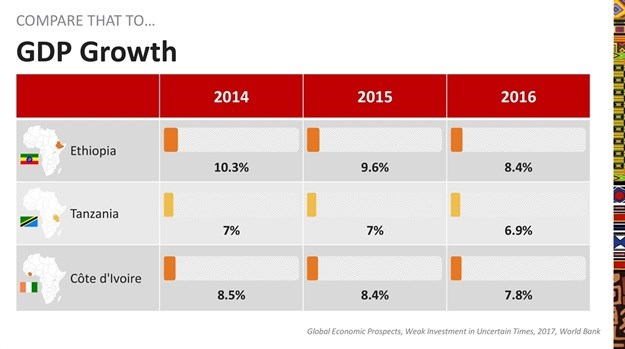

Paul Egan, managing consultant at UCT Unilever Institute told us that one of the reasons the study was started was due to the many misconceptions about Africa and that it is even more exaggerated when you look at some of the changes that have taken place on the continent in recent years. The other reasons include finding out where the opportunities are, where this specific shift has taken place and what this means to marketers. “If we look at what is happening at home in terms of economic growth, it's flat at 1.1% this year, maybe going up to 1.8% next year and then who knows. But growth in our country is very flat compared to other African countries like Ethiopia, with 10.3% in 2014 and 8.4% in 2016,” he said.

Ipsos works closely with the UCT Unilever Institute. They have a presence in over 10 markets in Africa and have been working there for the past 40 years. They have also worked in every country in sub-Sharan Africa, other than Chad. Nick Coates, country manager at Ipsos South Africa, says one of the reasons they took on this very ambitious study is because they spent a lot of time talking to clients who were asking, ‘Is Africa the next Asia?’, 'Is this a big opportunity?’. “We found that a lot of our clients, because of the anaemic growth in South Africa, were looking north. And a lot of them were going in there with a lot of unreliable and conflicting information, which resulted in a lot of their clients actually burning their fingers, making significant investments in the region and losing a lot of money. So a lot of questions came up and we felt that it was a big topic and we were looking for someone to actually start the conversation to unpack and understand what was going on in the region, which I think we've done.”

Trying to understand the growth power in sub-Saharan Africa

Haroon Bhorat, a professor of economics and director of the Development Policy Research Unit (DPRU) at the University of Cape Town, talked about the significance of the middle class and the challenge of defining it. Bhorat said it was important to not just look at the strong GDP of a country, but to also look at the nature of the growth trajectory of the economy because that will tell you if it is sustainable or not. Between 2001 and 2010 over half of the world's top ten performing economies were in this region. One of the more obvious results of this economic upswing is the emergence of the new middle class, dubbed the ‘African Lions’ across the sub-Saharan region. According to the African World Bank, the continent is now home to the world's fastest growing middle class.

Sub-Saharan economies that grow fast, like any other economy, will result in an increase in consumption levels, Bhorat said. He emphasised that commodity driven growth strategies is highly dependent on global commodity prices and used Angola as an example. Angola was the fastest growing economy in the 2000s but the growth was not sustainable because it was tied to resources. He said that growth sources must also be more diversified to remain sustainable. This happened during the African Rising period where foreign investors over-invested because they didn't check if the country's growth was sustainable or not.

Growth cannot be built based on commodities. How do we fix it? Bhorat says that countries should use revenue wisely when they have a commodity super-cycle. Spend revenue on infrastructure, skills enhancement and education, instead of, for example, on luxury goods. “We're now in a period where GDP is slowing down and corporates are reacting. Economies grew from being agriculture-based to manufacturing-based to technology-based,” he states. What needs to happen is that economies need to move to a manufacturing phase to become successful. Currently sub-Saharan Africa is in low-production mode – still in agriculture phase. “Manufacturing is the life-blood of an economy,” Bhorat says. If you're looking for drivers of growth, the nice thing is, if you're going into an African economy, in the cities it's where it is happening. It is often the size of the cities' GDP that determines the consumption market.

Africa’s silver linings

Bhorat said that Africa is not a country and should not be considered as such. There are many silver linings, but also huge deficits, and the answer is somewhere in-between. But he said one must be careful of how one understands these dynamics.

Silver linings:

1. The Demographic Dividend - Nearly 40% of the world's working age population is expected to reside in Africa by 2100 - up from 10% in 2015. Ten sub-Saharan countries will account for nearly 70% of the population growth in the region.

2. The Diaspora (emigration) - Remittances helps ODA (official development assistance) to remain stable. It is an important part of how you think about consumer markets, especially if it's becoming such a large part of so many different economies.

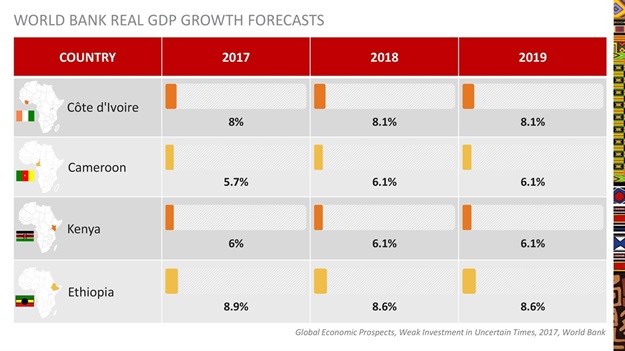

3. Growth forecast healthy for some - World Bank real GDP Growth Forecasts look at a country's resources. Are they resource rich or not and what are the growth factors?

4. Urbanisation - Africa's urbanisation rate is at 37% - leading to the growth of mega cities. Urban Africa is forecast to contribute nearly 40% of GDP growth.

5. Education - Investors need a sense that there's an existing skill set. Therefor countries need to focus on tertiary education.

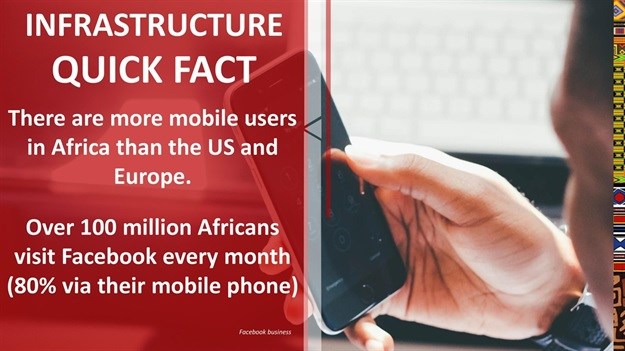

6. Infrastructure - Africa's infrastructure is under pressure. But there is an improvement and you can see it visually. An estimated $378bn is required for infrastructure development on the continent.

Understanding the middle class

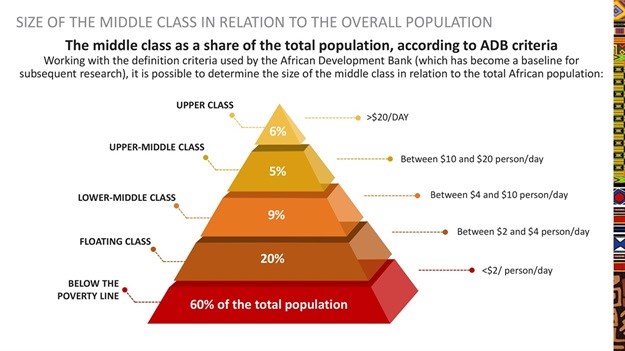

Middle class is an ambiguous notion because definitions of middle class differ. According to Bhorat there are two aspects determining middle class, data and definitions. But data is not enough, not regular, the standards vary and there are also too many infrequent surveys. He did reveal that the most important is the middle class consumes and that represents an opportunity. There is no single definition of the middle class. Definitions of the middle class is relative. Bhorat used a quote by Homi Kharas to emphasise this: "The middle class is an ambiguous social classification, broadly reflecting the ability to lead a comfortable life." Do not call them the middle class. "That’s too woolly," says Bhorat. "Call them low, medium and high spenders. Let us be clear that there are categories.”

- Low spenders spend $2 to $6 a day

- Medium spenders spend $6 to $13 a day

- High spenders spend more than $13 a day

How many people in each category depends heavily on the particular level of consumption you are interested in. To conclude his presentation, Bhorat used the below slide to illustrate how the African middle class is classified, using criteria by the African Development Bank.

Defining and segmenting the middle class in SA

Nanzala Mwaura, Ipsos African Lions team leader, presented on defining and segmenting the middle class in sub-Saharan Africa: demographics, income, credit, asset ownership and living conditions. She took us through the selecting process and explained how the study defined middle class. The definition used to define middle class included people living in cities, earning over $4 per day, have a disposable income, are employed, or run a business or are studying, made it to secondary school and are not earning more than $70 per day. Mwaura reminded us that we must keep in mind that Africa is not a country. Disposable income did not necessarily follow gross income, as shown by Luanda in Angola, which had the highest average income in the sample of 10 cities, but the lowest disposable income because of the high cost of living.

Segmenting the middle class

She said that what separates the middle class is that they are independent, future focused, like to plan, like to network and invest and save their money. There are three middle class segments:

- Accomplished - 32% of middle class who have an average household income of $19 per day. 45% are formally employed. 27% are self-employed. They have money for emergencies, their tertiary education is either in progress or completed. They have low debt, can afford food and clothing and have access to email, internet or a personal computer.

- Comfortable - 25% of middle class who have an average income of $15.70 per day. 32% are formally employed, and 31% are self-employed. They are 27 years and younger, single, not responsible for households and less likely to provide financial support to their families and to put money aside for emergencies.

- Vulnerable - 43% of the middle class who have an average income of $16.30 per day. 34% are formally employed, and 34% are self-employed. They are the most financially burdened, have high debt levels, the least stable income, but still save for emergencies, they are still able to support others and spend a lot of money on education and medical expenses.

A third of this group have a full-time job. 31% are self-employed and 13% are studying.

Ten myths of the African middle class

Mwaura also debunked a couple of myths concerning the African middle class.

1. Middle class people have good incomes.

False! Average individual income is $12.3 per day and average household income is $16.9 per day. 71% said their income varies from month-to-month.

2. Middle class people have a comfortable life.

False! 42% of households have running water inside the house. Only 20% have hot running water. Only 69% have a flushing toilet inside the house. Only half have a build-in sink. But most 96% have electricity, although power cuts are common. In Lagos 80% have a generator.

3. Middle class consumers own a lot of stuff.

True!

4. Middle class people are home owners.

True and false! Home owners is not a given - 48% own their home or it's owned by a household member and 52% rent.

5. Middle class people own cars.

False! 68% of households do not own a car, public transport is the norm.

6. Middle class people are well-educated.True! 54% have some form of education post high school and 31% are studying further to improve their skills.

7. Middle class consumers live in a nuclear household.

True! City dwellers typically lives in small household units.

8. Middle class consumers have the ability to buy brands.

True and false! 45% have enough money for food and clothing but not much else. 37% can afford other things but not everything they would like.

9. Middle class consumers are less traditional.

True! They focus on looking forward but respect for some aspects of tradition remain.

10. Middle class women are more empowered.

True! Women today are more empowered to make decisions about their own careers. But women are less likely to be earning high incomes. 55% of those earning $30-$40 are men.

About Juanita Pienaar

- #Newsmaker: Producer Eddie Chitate launches Africa's newest streaming platform - 4 Nov 2020

- #2020AfricaBrandSummit: The role of PR and communication during crisis - 14 Oct 2020

- #IABInsightSeries: Marketing partnerships in the digital economy - 12 Oct 2020

- #DoBizZA: Just Brands Africa gives back to SA by helping educate future leaders - 30 Sep 2020

- #Newsmaker: Deshnie Govender launches new podcast - 25 Sep 2020

View my profile and articles...