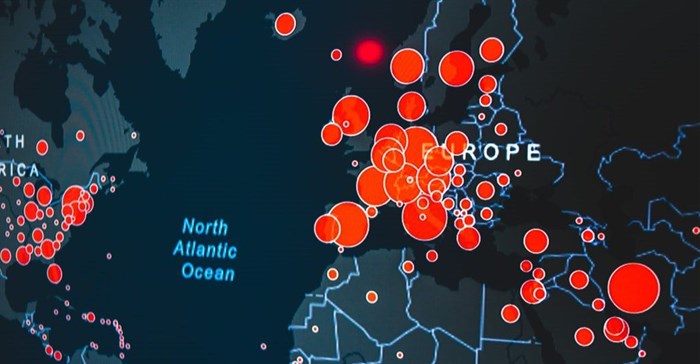

The 2003 Sars outbreak, which infected over 8,000 people and killed 774, cost the global economy an estimated US€50bn. As of 18 March 2020, there have been 218,663 cases and 8,943 deaths of Covid-19 confirmed worldwide. Global spread has been rapid, with 146 countries now having reported at least one case.

Brand Finance has assessed the impact of the Covid-19 outbreak based on the effect of the outbreak on Enterprise Value, as at 18 March 2020, compared to what it was on 1 January 2020. Based on this impact on Business Value, Brand Finance estimated the likely impact on Brand Value for each sector. Each sector has been classified into 3 categories based on the severity of Business Value loss observed for the sector in the period between 1 January 2020 and 18 March 2020.

David Haigh, CEO of Brand Finance, commented:

The Covid-19 pandemic is now a major global health threat and its impact on global markets is very real. Worldwide, brands across every sector need to brace themselves for the coronavirus to massively affect their business activities, supply chain and revenues in a way that eclipses the 2003 Sars outbreak. The effects will be felt well into 2021. However, It is not all doom and gloom. Some brands will fare better under Covid-19: Amazon, Netflix, WhatsApp, Skype, BBC and BUPA are all booming.

Brand Finance today released the Europe 100 report on Europe’s top 100 most valuable and strongest brands. With a current Combined Value of EUR 1,163,937m, all the top 100 European brands are estimated to drop 13% in value following the impact of Covid-19.

The report was set to be launched this week at the continent’s preeminent gathering of the creative industries, Advertising Week Europe, which has been postponed due to the coronavirus outbreak.

On 1st January 2020, European brand value growth was slower than in previous years, at 5% (up to €1,135bn). The trade war last year and worries about the global economy weighed down on growth for the big exporters – particularly cars, which saw slower growth than previous years. German automobile excellence is to be commended as the top 10 brands in Europe are dominated by German autos Mercedes (up 13% to €58bn), BMW (up 5% to €37bn), VW (up 13% to €40bn), and Porsche (up 21% to €31bn).

Although Europe has seen faltering growth, the automobile industry has recently been going from strength to strength. The industry makes up almost 20% of overall brand value and has grown 10% this year (relative to the overall growth of 5%). It is one of the key industries that Europe leads as its brands have successfully innovated in the face of many new challenges and opportunities.

For the third consecutive year, Mercedes-Benz’s brand is the most valuable automobile brand in the world. The German brand has been investing strongly in R&D and has been one step ahead in the anticipation of new trends – particularly electric and autonomous vehicles.

Despite their strength, Mercedes and its parent company Daimler are already being affected by the virus. Daimler has stopped all manufacturing and demand is drying up. If social and economic restrictions are lifted within the next few months, purchases might only be delayed and the long-term impact small but longer-term delays could produce a long-term shock to a sector already challenged by disruption, trade wars and slowing demand in China.

Elizabeth Petra, director at Advertising Week Europe, said:

In this report, there are a wide variety of brands that have become household names around Europe. Many of these companies are business giants that have been established on the global stage over generations, whilst others have grown quickly in recent decades in response to changing consumer needs. All of these brands have been built through hard work and creativity over many years, putting themselves in a strong position to consolidate their place and lead the way through uncertain times.

Assessed as the hardest hit sector are airlines, leisure and tourism, aviation, aerospace and defence. The global airline industry has called for up to €200bn in emergency support and Boeing called for €60bn in assistance for aerospace manufacturers. The International Air Transport Association (IATA) has said most carriers will run out of money within two months as a result of the closure of borders for arrivals as governments order a shutdown to contain the coronavirus outbreak. A large number of major airlines have grounded most of their fleets and announced plans to lay off thousands of staff as they now confront a crisis unlike anything ever seen before in the airline industry.

As per Brand Finance analysis from the start of the year, Airbus had risen by 15% (to €13bn) and Safran 7% (to €6bn) as rising defence budgets and increasing demands from airlines helped grow their business. Our new analysis suggests that all of this growth will be reversed.

Luxury apparel brands are strong performers in the Europe Top 100 – all of the large luxury apparel brands have risen in value this year. Gucci, Louis Vuitton, Lancôme and Chanel all achieved significant brand value growth despite the slowing demand in China and a generally weakening growth last year.

However, the luxury industry, is also classified as high impact, is feeling immediate effects from Covid-19 outbreak, as highest spend on luxury comes from China, where the outbreak began in Wuhan province in December 2019. As the health epidemic takes its toll on the high street and forces shops to shut, the impetus for luxury purchases will be the first to fall.

David Haigh, CEO of Brand Finance said:

The harsh reality is that many brands are not going to make their 2020 targets due to the unprecedented challenges of the Coronavirus outbreak. It is hoped that lenders will be forthcoming in offering additional flexibility and liquidity.Global sporting and sponsorship effects

These measures have a knock-on effect not only on the huge amounts of spectators, sporting enthusiasts, athletes and coaching community but also on the sponsorship, retailers, merchandise market, viewership figures and contractual agreements on advertising and promotional activities around such high-profile sports fixtures.

Brands offering in-home or remote working solutions have observed an immediate uptick in demand, as workforces across the world are dispatched to work remotely. Zoom, which facilitates virtual meetings, is inundated with signups as the coronavirus outbreak has prompted office closures and meeting cancellations. Business seminars, university courses and even children’s playgroups have all moved online as people worldwide adopt the reality of social distancing, self-isolation or quarantine.

Food delivery apps Deliveroo and UberEats, now offering contact-free delivery options whereby a food delivery is conveniently left on your doorstep so as not to encourage contact between customer and delivery driver, have also seen a huge surge in demand for their services.

Media and film industry feel effects

Film production and promotion schedules have been affected by the outbreak, with Disney pushing back the release of its remake of Mulan as well as The New Mutants, part of the X-Men franchise. Hollywood is also feeling the effects of the coronavirus pandemic as the 25th Bond Film, No Time To Die, has postponed its official premiere and release until 25 November. The box office will be hit hard as a knock-on effect from the closure of cinemas around the world.

The effects of social distancing may mean more viewers are home watching TV or streaming online, however, Netflix has announced its decision to suspend production on all scripted series and films in the US and Canada. As massive televised sports events and festivals such as Glastonbury and Coachella are cancelled, music and TV executives will be feeling the strain of providing fresh and watchable content.

View the Brand Finance Europe 100 with Covid-19 Impact report here.