The saying goes “how big is the pie”, which refers to the size of the national economy or the gross domestic product (GDP) of a country. More specifically, it also refers to how big the piece of the pie is in the fast food industry. The size of the pie is best defined by looking at the extent of expenditure in the fast food industry.

A key part of defining the size of the fast food industry is knowing the size of the population and their disposable income to see who can afford to purchase fast food. However, it is far more than just the size of the population, it is very much about their consumption behaviour toward fast food and specific brands in particular. Not only that, but one also has to have an understanding of the frequency of spend, basket size and the amount spent.

Access to fast food outlets will of course play a critical role in whether people with the right socio-economic characteristics will buy fast food. Considering the factors that South Africa faces in the present economic and Covid-19 climate, there remain opportunities for new greenfield fast food locations as well as filling in the “gaps” in the market.

However, the high levels of risk within the fast food market must be taken into consideration, especially with the increasing potential of further lockdowns leading into the Christmas holiday period. This in most instances will dampen the mood of companies in making short-term decisions in expanding their fast food restaurant networks. On the other hand, larger fast food brands may see this as an opportunity to cherry-pick prime locations where competitors used to be located.

The Nobel Laureate and economist, Paul Krugman, who developed the theory of ‘new retail geography’ emphasises that it is not only a consequence of growth in the general economy that will allow the fast food market to grow. It is also about achieving economies of scale within a market that results in a circular causation of growth that increases returns on investment within the fast food sectors sector, as an example.

This is understood to mean that through agglomeration or clustering of differentiated retail or fast food outlets, one is able to create economies of scale that encourage developments in other secondary and tertiary sectors that contribute to the overall growth of the economy. What this means is that as the economy in South Africa grows, new opportunities will arise for the expansion of the fast food industry. However, the fast food industry itself can play a role in stimulating economic growth through the development of Greenfield sites and the clustering of retail facilities.

Up until 2019, there had been explosive growth in the global fast food market with a growth of 4.5% between 2015-2020 and a projected growth of 5.6% up to the year 2026. Then Covid-19 hit the global community at the beginning of 2020 and since then the fast food industry, globally and in South Africa, has been under significant pressure. At that stage, research showed that there was still opportunity for growth in the fast food industry in South Africa, but it was beginning to saturate.

The key driver of growth in the global and South African fast food industry up until 2019 was an increase in the number of working couples, disposable income, accessibility, and low cost of fast food. Other contributors were population growth, growth of the middle class, urbanisation, economic growth as well as increases in business, domestic and international tourism.

The increase in the number of fast food outlets was a further contributor to the growth in the industry. However, changes in eating habits towards more healthy food options, eating at home and the ageing population was expected to hamper growth in the fast food industry globally.

In 2018 the size of the takeaway and fast food market in South Africa was between R22.4bn and R 26.4bn. Growth in customers buying fast food increased by 66% in 2019 and by 80% in 2015. This resulted in the number of fast food customers increasing to 42 million in 2019. The industry was expected to grow faster than inflation with an annual growth in the number of fast food outlets being 4%. This resulted in the South African fast food market being described in the media as “piping hot” and experiencing “exponential growth”.

All of this was happening while South Africa’s economic growth and foreign direct investment remained low but was projected to pick up slowly even though it would remain vulnerable to policy uncertainties and external shocks. Unemployment had remained consistently high at 28% with private consumption increasing only by 2.1% while wages increased moderately over the same time period.

This was within the framework of the global economic growth showing a downward trend of 3% in 2018, 2.9% in 2019 and projected to decline to 2.8% in 2020- 2021. This was all before Covid-19 struck and stagnated the global and South African economy, which is now continues to be exacerbated by the frequent electricity loadshedding.

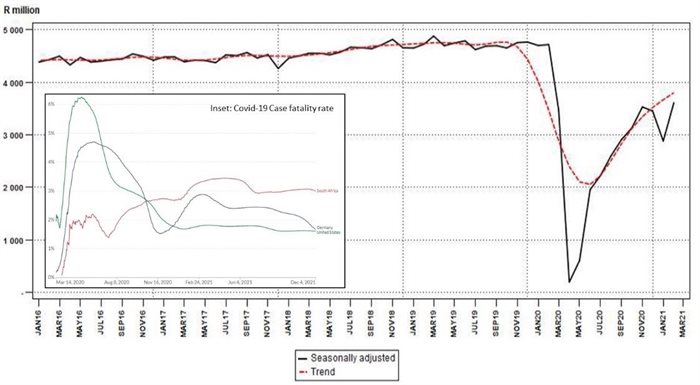

The figure below shows income in the food and beverage industry from January 2016 to March 2021 from Statistics South Africa’s 2021 report. The industry literally fell off a precipice in January-February 2020, just after the holiday season in 2019. It has shown improvement leading up to March 2021, but Wave 4 of the ongoing Covid-19 pandemic is starting to take effect, although its potential impact on South African society from a morbidity, hospitalisation and mortality perspective still has to be determined.

In taking further decisions about lockdowns in South Africa with the rapidly increasing number of Covid-19 cases, the government will be cognisant of the fact that South Africa, compared to many other countries in the world, has a high fatality rate (see inset). This is in comparison to Germany whose cases have spiked to over 56,000 cases compared to over 16,000 cases in South Africa, yet their fatality rates are lower than ours.

Further lockdowns in this critical part of the year where the fast food industry generates up to 80% of its revenue, will place significant pressure on the industry.

Our research has shown that when the industry is under such pressure that poorly located fast food restaurants do not recover. This places immense pressure on large parts of a brand's restaurant network. Although the fast food industry has shown significant resilience under these conditions, the length of the constrained operating environment will begin to take its toll.

Some fast food brands will need to seriously consider rationalisation of their restaurant networks to remain sustainable. Some of the larger brands with significant liquidity, especially from holding companies outside of South Africa, may see this as an opportunity to take up prime sites from competitors and expand their restaurant networks.

To do this, fast food brands will need to look at their restaurant networks much more holistically and use more scientific approaches in making decisions about either rationalisation or expansion. These scientific approaches are known as accessibility studies that identify the optimum number and location of restaurants in the network considering the present socio-economic conditions so as to maximise their market share within the smallest area across a transport network.

Part of the scientific approach is to consider the Diamond of Spatial Network Analysis - a concept developed by looking at the sustainability of the fast food and other retail industries.

There are four components included in this concept that includes demand, supply, accessibility, and consumer purchasing behaviour. Demand refers specifically to the dynamics in the target market, which in essence is the extent of takeaway and fast food expenditure in the general population at a local level. It is not simply about understanding the size of the target market but having a clear understanding of the minimum capacity required in the target market for fast food restaurants of different types and sizes to be established.

What must also be taken into consideration is the dichotomy within the target market of where people live and work. Covid-19 has significantly impacted the daily movement of the working population, and this must not be taken into consideration when locating new fast food outlets. It has also had a significant impact on the visiting commuter population, which in essence is business people travelling to attend meetings and returning on the same day.

The extent to which the target population purchases fast food and their socio-economic characteristics can assist brands make more informed decisions about their marketing and advertising strategies to recruit new consumers into the fast food industry.

Supply is about understanding where brands’ restaurants are located and that of their competitors. Having this information allows companies to understand the trade areas of their restaurants to determine the extent of potential cannibalisation and conquest that may occur from competitor outlets.

However, it is also about understanding the location of preferred prime sites that have high levels of customer attraction, such as shopping malls of different sizes or other hubs. A significant constraint in the expansion of the fast food industry is the availability of suitable floor space. This necessitates companies in the fast food industry developing shopping centres where there can be the clustering of symbiotic retail outlets.

Accessibility is about understanding that customers use different modes of transport across the transport network to access fast food outlets. The cost of transport will always affect the travel elasticity of customers, that is, the distance or time that they are willing to travel to reach a particular facility. Therefore, understanding the average travel time or distance that a customer is willing to travel to reach a fast food restaurant is of critical importance.

What is also of vital importance is understanding the consumer purchasing behaviour of the target market. It is all good and well understanding the extent and distribution of the target market, where restaurants are located and how they can be accessed, but without understanding consumer purchasing behaviour, poor decisions can be made in developing fast food restaurant networks. Information on market share of fast food brands and average spend are key parameters in effectively developing any fast food restaurant network.

It is this type of holistic approach that needs to be considered in the future expansion or rationalisation of the fast food industry in South Africa. Covid-19 over the last two years and a sluggish economy over nearly a decade before has had a significant impact on the fast food industry. Post Covid-19 opportunities for economic growth will enable the fast food industry to grow but the industry itself has a role to play in the development and growth of the South African economy.

There continue to be significant risks that must be taken into consideration to sustain the fast food industry into the future. This includes saturation within the more urbanised higher per capita income areas and the lack of floor space for new restaurants, especially in townships and similar urban areas.