This is from Gartner’s report Predicts 2021: CRM Customer Service and Support. Today Chat 2 Pay is being launched by Clickatell, a mobile communications and chat commerce organisation.

Clickatell describes Chat 2 Pay as a simple and comprehensive way for merchants to offer payments and transactions to consumers in chat.

“Chat 2 Pay addresses today’s boom worldwide in digital payments – a shift in consumer behaviour and response to the impact of the pandemic,” says Pieter de Villiers, Clickatell CEO and cofounder.

It also helps address consumers’ physical proximity concerns, while reducing fraud. “Chat 2 Pay delivers a secure, frictionless, and contact free checkout—with no need to hand credit cards to merchants or read card details over the phone,” he adds.

In its design of Chat 2 Pay, Clickatell efficiently has orchestrated the complex relationship between messaging, payments, or the order management system (OMS) of their customers, and in the process mitigates the risk of merchants managing payment card details. The functionality is so easy merchants simply switch it on and manage.

Clickatell’s own data shows using the chat channel for interactions and transactions reduces the overall cost of doing business while increasing customer engagement.

“Brands can now improve their customer service with Chat 2 Pay by providing a more convenient and secure way to make payments in chat messaging,” says de Villiers.

In its report Drive Revenue and Customer Satisfaction by Building Trust Gartner states: “Not only is an organisation’s trustworthiness measured by its people, it is also measured by its processes and the technologies it deploys. All agents can help or hinder the building of customer confidence and trust and negate millions of investments in people, process and technology.”

“As chat commerce accelerates, we are innovating to create payment systems like Chat 2 Pay where all brands no matter the size may accept payments in the chat channels consumers have come to love, trust, and use every day,” de Villiers says.

“By taking the payment capabilities brands have on their websites, apps, and in their call centres, and making them available via chat, simpler payments will further drive adoption of this low-cost, efficient channel for interactions and transactions.”

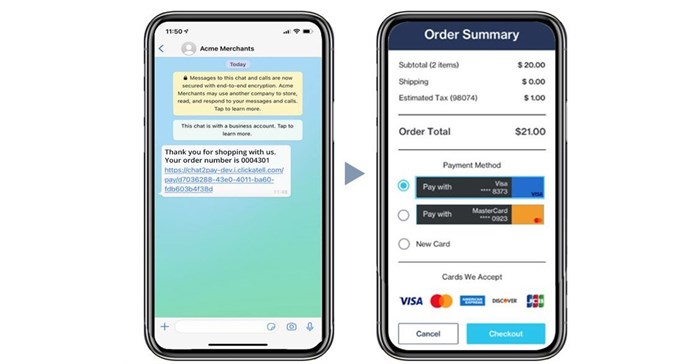

The Clickatell Chat 2 Pay solution provides a pay-by-link capability, empowering brands to request and facilitate payments in three easy steps:

Clickatell is offering Chat 2 Pay to midsize and large businesses around the world.