Marketing & Media trends

Industry trends

BizTrends Sponsors

Trending

#BizTrends2023: Key trends in the automotive industry for 2023

While these future trends are important, it’s always some distance off for South Africans: our market, our here and now, is very different despite some consistencies with global trends. On local soil, these are the five things we expect in the automotive industry in 2023.

A new car may be the most responsible thing to do

Globally, and overall, we are in an inflationary environment where wages have not kept pace with the increased cost of living. In South Africa, this is an even more acute reality for most and despite Cyril Ramaphosa being elected for a second term as ANC president, political uncertainty and poor service delivery will continue to weigh on consumer sentiment – the state of our roads and consistent rolling blackouts, or load-shedding as we tend to sugar-coat it, serve as daily reminders.

From a motor retail perspective, the cost of the principal asset and the cost of financing that asset are growing. Running costs, most markedly fuel costs, are also on the rise. Given that these overarching mobility costs tend to be such a big part of the household budget, we can expect transaction volume from people changing cars – and mobility consumption patterns – to make ends meet. Almost counter-intuitively, splashing out on a new car may be the most responsible thing to do!

Towards a buyer's market

Extended manufacturing constraints and component shortages post-Covid has had a huge impact on vehicle sales globally for the past few years, with demand often exceeding supply. In 2023, global inflation will drive up the cost of manufacturing, and in a country where more than 70% of our vehicle sales are imported, this – combined with the general weakness of the Rand – will encourage most, if not all, players to increase the recommended retail pricing of their products.

However, these price increases will be tempered by an easing of manufacturing constraints, causing a gentle shift into an oversupply market. It will become more of a buyer’s market, but don’t expect aggressive discounting. I expect another 10% growth in sales volumes in 2023, with the brands considered ‘more affordable’ taking the lion’s share.

Buy-down, value-up

The strong buy-down trend we saw emerging just before the Covid lockdown has continued, and I expect more of the same in 2023. The middle-of-the-market consumer is increasingly pragmatic in their choices. Versatile crossovers and fuel-efficient cars with integrated smartphone functionality and service plans will remain popular, and proven brands with long-term market presence will do well.

Despite some new entrants in the market showing very positive results based on a price point promotion, history has shown that, in tough times, consumers become more conservative and less likely to chase an eye-catching bargain from a new brand. They would rather buy down into a trusted brand than take a punt on something with less legacy.

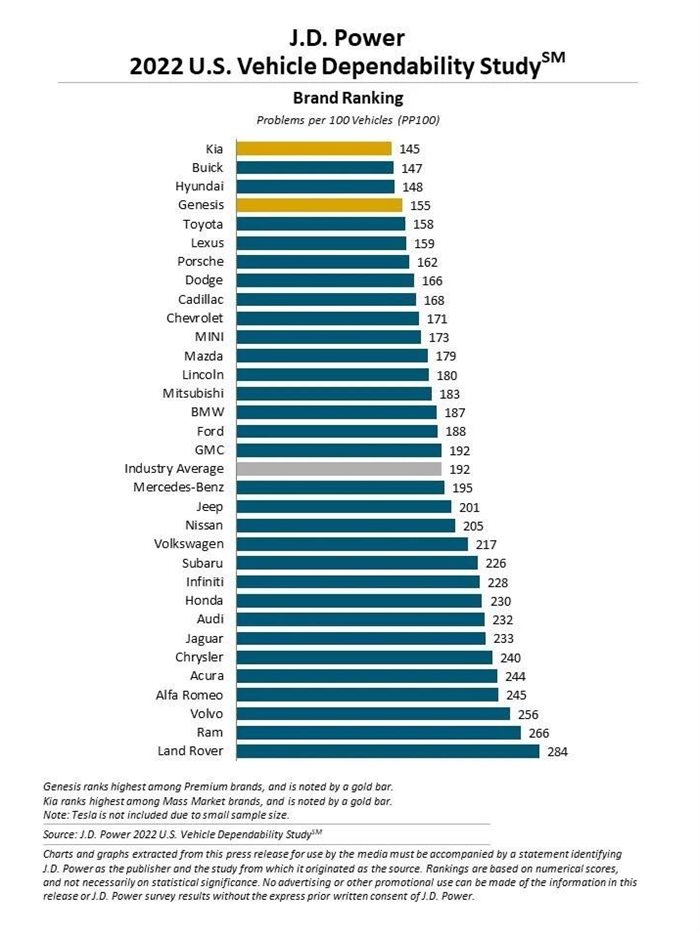

Many consumers will this year reconsider which brands they perceive as reputable, and in the process discover that the brands they considered fly-by-nights ten or more years ago are still here, with almost unfathomable increases in quality and reliability, and offering value for money that the brands most South Africans have traditionally aspired to simply do not offer anymore. This is already evident from the numbers reported in the premium and luxury segment, which is very thin in relative terms.

A slow burn for new energy vehicles

Don’t expect demand stimulus from the fiscus. The numbers being bandied about are exceptionally tepid when compared to markets where any kind of real shift towards “new energy” vehicles (electric, hybrid, fuel-cell) has occurred. Modelling has suggested a more aggressive approach would be self-funding – and help secure a green future – but government seems pre-occupied with concerns around import displacement and the potentially negative political optics of subsidising elite EVs while most of the population struggle to make ends meet.

We expect clean fuel policy (which supports hybrid engine technology) before cheap and reliable electricity (which creates confidence around charging), so this coupled with the cost differential between the technologies will ensure South Africa as a late starter doesn’t leapfrog straight to pure electric: volume will first come from hybrids, and then full EVs in the second half of the decade.

From ownership to consumption

Far fewer cash deals are being done nowadays, largely because the consumer has become poorer: we no longer fund from our growing personal balance sheets, accessing bonds where the underlying property has shown healthy growth in value, for instance.

Although formulated with good intent, the increased regulatory burdens on cash deals and instalment-sale financing make buying a car the traditional way harder than it seems it ought to be in our fast-buy, convenient Takealot and Netflix world. With all this risk and complexity, working with a reputable dealer is more and more important, but that’s not all.

Subscription-based offerings, also referred to as MaaS in some instances, will grow the addressable market if they can overcome the affordability-killing risk mitigants generally associated with such models. If it is achieved, more cars will be sold. 2023 could be the year this becomes a reality.

About Gary Scott

Gary Scott is the CEO of Kia South Africa, and the Vice President: Retailing OEMs, of naamsa, the automotive business council.- Double win for Kia at the inaugural TopGear South Africa Awards18 Dec 11:29

- Kia South Africa launches 'Test Drive for Good' campaign over Heritage Day weekend in KwaZulu-Natal19 Sep 12:19

- Kia The Glen takes top honours in the 2023 Kia Dealer of the Year Awards05 Sep 11:22

- Kia EV9 wins Luxury category in German Car of the Year 2024 Awards01 Sep 15:37

- Kia donates R70,000 towards the RADA MiPad project to empower more girls in Women's Month29 Aug 10:11