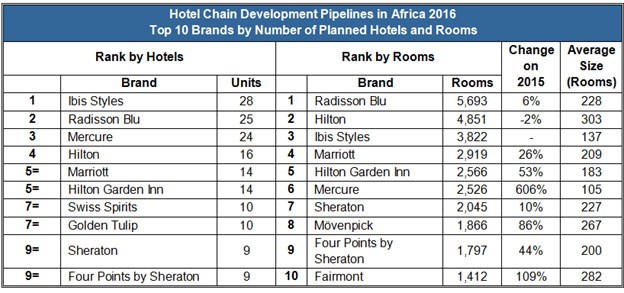

According to the annual Hotel Chain Development Pipeline Survey, from W Hospitality Group, Ibis Styles leads the top 10 brands list. It has 28 planned hotels, followed by Radisson Blu with 25, Mercure with 24 and Hilton slipping into fourth place with 16. Ibis Styles and Mercure’s first and third positions are due to AccorHotels mega-deal for 50 hotels in Angola.

The W Hospitality Group 2016 survey provides a comprehensive picture of hotel development across the continent - 36 hotel chains and 86 brands with more than 64,000 rooms in 365 hotels. The survey, now in its eighth year, is published ahead of the AHIF Hotel Investment Forum (AHIF), which is organised by Bench Events, and takes place in Togo on June 21-22.

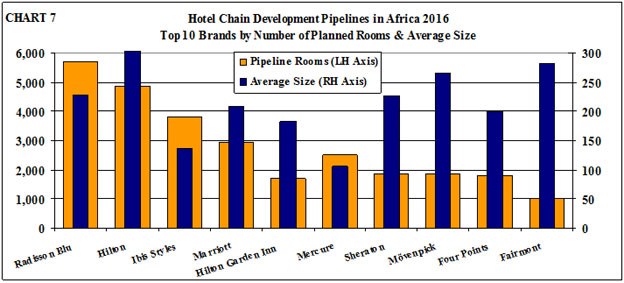

While Ibis Styles leads on the number of planned hotels, the top ten rankings by number of rooms reveal a different picture. Radisson Blu leads this category with 5,693 planned rooms, Hilton is in second place with 4,851 and Ibis Styles comes in third with 3,822.

The hotel pipeline for Hilton’s core brand has reduced slightly but the Hilton Garden Inn brand shows higher growth, now at 14 hotels with 2,556 rooms. Also seeing strong growth, but from a small base, is the Fairmont brand, up 109% with 1,412 planned rooms.

Hilton is signing the largest deals, with an average of 303 rooms per hotel, closely followed by Fairmont, averaging 282 rooms, and then Movenpick. The AccorHotels deal is for a large number of relatively small hotels.

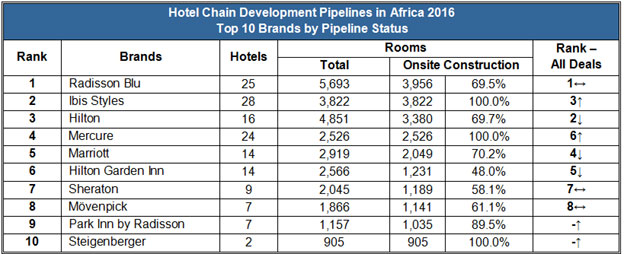

In terms of pipeline status, traditional leaders Radisson Blu and Hilton are joined in the top four rankings by AccorHotel’s Ibis Styles and Mercure. All AccorHotel’s hotels in Angola are under construction.

Several chains have more than one brand they are either establishing or expanding in Africa, such as Starwood which has signed deals for eight brands.

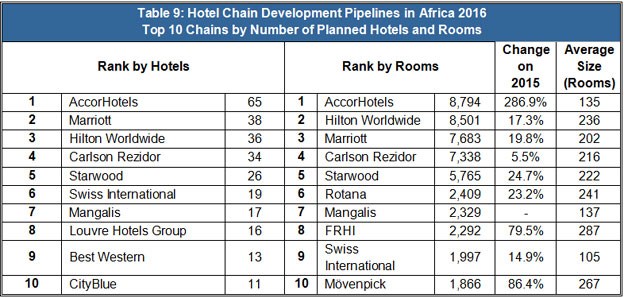

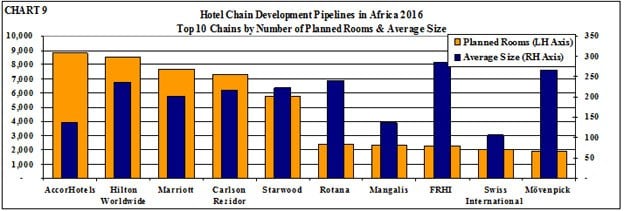

Due to its mega-deal in Angola, AccorHotels leads the table of planned hotels and rooms by hotel chain, rather than by brand. Hilton Worldwide comes in at second place. Carlson Rezidor shows lower growth, just 5.5% on 2015. But it’s worth remembering that it opened the most hotels of any chain in 2015, a total of eight Radisson Blu and Park Inn hotels with 1,460 rooms. The chain continues to make good progress, signing seven new deals in 2015 with 1,400 rooms. Starwood also experienced strong growth, adding 1,142 rooms to its African pipeline and Movenpick moved up a gear, signing deals in Abuja, Abidjan and Nairobi.

Of the top 10 chains, seven have an average size per deal of more than 200 rooms. For the entire survey, the average is 176 rooms per hotel – 230 in North Africa and 159 in sub-Saharan Africa.

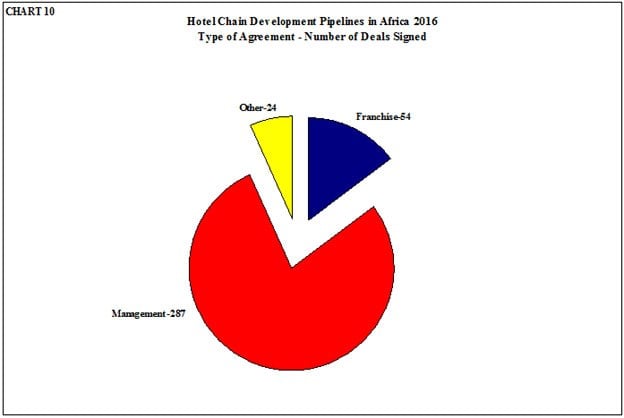

The 2016 W Hospitality Group research shows the majority of hotel chains are signing management contracts for their new deals. Most of the franchises or quasi franchises, such as licence agreements, have been signed by Best Western and Swiss International. The “other” category includes joint ventures between chains and owners, owner-operators and a very small number of leases.

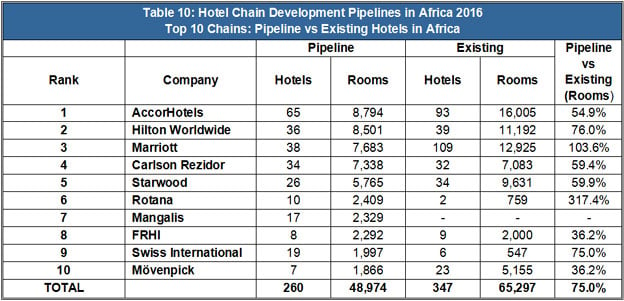

A look at the chains’ planned hotels and their existing presence on the continent reveals that the top 10 all plan to expand significantly, most by 50% or more. The highest %age increase is for Rotana, but this is on a very low base.

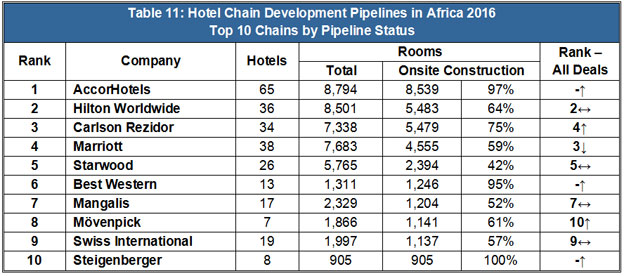

A comparison of “on paper” and “on site” shows AccorHotels is in the lead, followed by Hilton Worldwide, Carlson Rezidor and Marriott. While Mangalis, with its Noom, Yaas and Seen brands, has no hotel in operation, eight are on site and three will open in 2016.

2015 was a bumper year for deals being signed. There was a record 121 new deals signed including the AccorHotels deal for 50 hotels in Angola. Between 2006 and 2013, 104 deals with 21,377 rooms were signed and should now be open. But for many reasons, most often a lack of finance, they are either still just on paper, or in some cases, remain unfinished.

While there is great promise in Africa, there is also uncertainty. Ten hotels with 2,840 rooms have no opening date. In North Africa, countries such as Libya and Egypt, have been hit by terrorism and political unrest, and this had delayed work on a number of projects. Middle East funding for projects in North Africa has also been affected by the oil price crash.

Despite this, over the next three years there will be 47,000 new rooms in 293 hotels and the expectation of much more to come, including deals that have already been made in the first quarter of 2016.

Trevor Ward, W Hospitality Group managing director, said: “We have seen phenomenal growth in the hotel pipeline, 64,000 new rooms, almost 30% up on the previous year. Whilst the biggest story has been AccorHotels’ mega-deal in Angola, even without it, we would have seen strong growth.”

Matthew Weihs, managing director of Bench Events, said: “Investors are evidently becoming increasingly willing to back Africa’s success. When one looks at the very small number of hotel rooms compared to the size of the population and a growth rate of around 5%, the appeal is clear. When one adds in the perspective that hotels are essential infrastructure for countries trying to attract inward investment and stimulate growth, I expect AHIF Togo in June and AHIF Rwanda in October will both be full of fervent networking.”

The 2016 survey will be discussed in detail at AHIF in Lomé, Togo on 21-22 June 2016, at the new flagship Radisson Blu Hotel du 2 Février. The second AHIF will take place on 5-6 October at the Radisson Blu Hotel & Convention Center, Kigali, Rwanda. For more information, visit www.Africa-Conference.com.