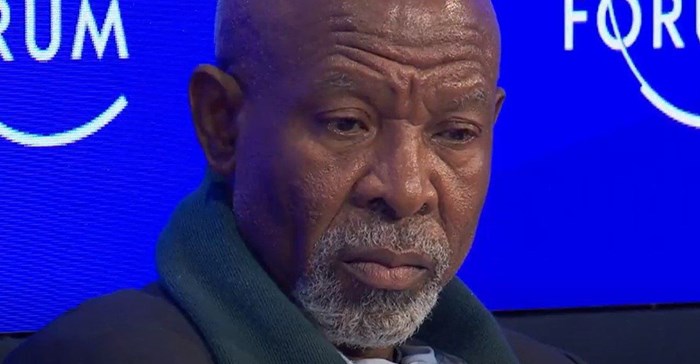

This was the message of the South African Reserve Bank (Sarb) governor, Lesetja Kganyago at today's official public repo-rate announcement.

Just four months ago the MPC's last repo-rate was hiked by 75 basis points.

The news comes on the back of South Africa's rising inflationary pressure from loadshedding, high food and transport costs, and no end in sight to the Russia/Ukraine conflict.

Three members of the MPC committee preferred the announced increase, two members preferred a 50 basis points' increase.

Economists had widely predicted an increase of 50 basis points from the MPC in January, however, today's announcement is attributed to the surprise decrease in the consumer price index (CPI).

According to data released by Statistics South Africa consumer price inflation (CPI) fell to 7.2% year-on-year in December, down from 7.4% the previous month.

"The revised repurchase rate remains supportive of credit demand in the near term while raising rates to levels more consistent with the current view of inflation and risks to it," Kganyago said.

The aim of policy, he added, is to anchor inflation expectations more firmly around the midpoint of the target band and to increase confidence of attaining the inflation target sustainably over time.

Guiding inflation back to the midpoint of the target band can reduce the economic cost of high inflation and aim to lower interest rates in the future, he said.

"Achieving a prudent public debt level, increasing the supply of energy, moderating administered price inflation and keeping wage growth in line with productivity gains would enhance the effectiveness of monetary policy and its transmission to the broader economy."

"Monetary policy decisions will continue to be data dependent and sensitive to the balance of risks to the outlook. The MPC will seek to look through temporary price shocks and focus on potential second-round effects and the risks of de-anchoring inflation expectations. The bank will continue to closely monitor funding markets for stress."

Economic and financial conditions are expected to remain more volatile for the foreseeable future.