In 2019, South Africa’s e-commerce industry was in its infancy stages, accounting for 1.4% of the total retail spending and 8% of total card payments spent in the retail space. In 2020, e-commerce spending grew by 30% while the average brick and mortar (or physical spending) decreased by 12%.

Due to the national lockdown imposed by the government in response to the pandemic, traditional retailers needed to reform their business models to draw their customers in without the enticements of malls. This accelerated the need for digital innovation, shifting consumer expectations to increased online consumption enabling South Africa to follow global trends.

This pushed the pace of change into hyperdrive with some business models thriving and others suffering early retirement. By the end of 2020, South Africa saw a 50% to 70% growth in e-commerce, with an increased uptake in online retailing, click-and-collect and video streaming. Furthermore, online spending on goods and products (other than travel and accommodation) doubled in 2020, reflecting a 102% increase.

By 2021, the industry had witnessed an additional 39% growth, with e-commerce accounting for 14% of the total card payment sales.

According to FNB Merchant Services statistics, total online sales increased by 55% in 2020 driven by increased spending in less traditional e-commerce industries. By 2021, online spending had grown by another 42% with robust transaction values reaching 500 million. By 2025 the value of e-commerce transactions is expected to surge by 150% reaching R225bn, in response to a shift in consumer behaviours.

The market is estimated to reach R400bn by 2025, facilitated by over 1 billion transactions annually. Currently, e-commerce card purchases are at 8% of the total card purchases in South Africa. However, in the next 5 years, this value is expected to grow to 20% with an annual average growth rate of 16%.

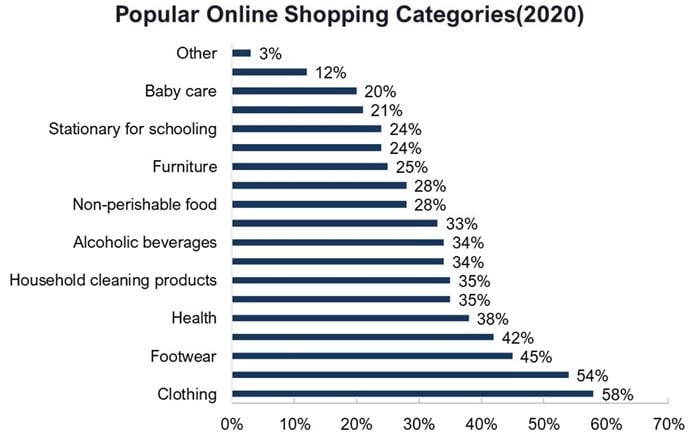

Currently, the South African online e-commerce industry is estimated at just under R200bn per annum and is continuing to grow rapidly, with companies such as Takealot, Checkers, Pick n Pay and Woolworths adapting to meet new consumer habits. Clothing, electronics, footwear, household appliances and health products were amongst the most popular categories in South Africa’s online market, with groceries having witnessed a 54% increase since 2019.

Accordingly, 64% of South African consumers had bought groceries online for the first time and 53% had made their first online purchase from a pharmacy.

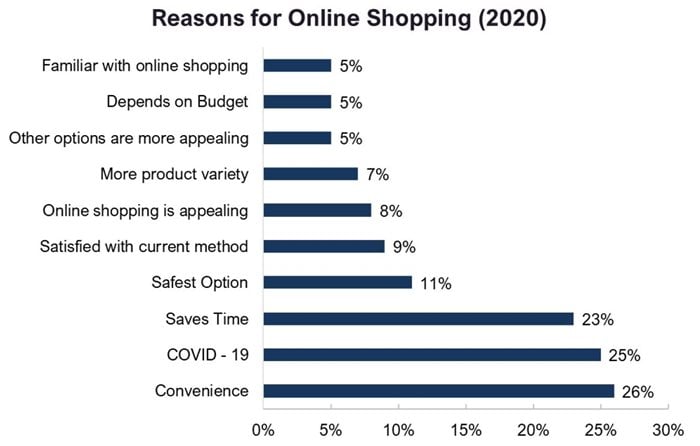

The pandemic acquainted South Africans with online shopping, highlighting its convenience while enabling the growth of the e-commerce market. The frequency of online shopping is set to increase; however, the focus of retailers needs to be on creating an omnichannel shopping experience; that provides consumers with a blended shopping experience of in-store and online shopping.

Furthermore, key stakeholders in the market need to innovate and invest to overcome the challenges in the industry as insecurity remains high. Looking ahead, South African businesses that will succeed in the new world will be those that have demonstrated an ability to seamlessly meet new consumer demand preferences, shifting their bricks and mortar services to online while addressing some of the key challenges the industry experiences.