Traditional market research has a distinct need in the business world as accurate consumer insights and information can be used to inform strategic decisions for growth. However, it appears that business leaders are looking for more than just consumer-based research to guide their decision making.

According to ESOMAR, the world association for market, social and opinion research: “Spending on market research grew by 2.8% year over year in 2013 (0.7% after adjusting for inflation) to exceed $40 billion with the broader ‘business intelligence’ market growing by 50% to surpass $60 billion.”

So what is this broader ‘business intelligence’ and what has accelerated the demand in recent years? From Freshly Ground Insight’s (FGI’s) experience on the African continent, it appears that having a sound understanding of the needs, preferences and perceptions of consumers within a product category may not be enough to guarantee success.

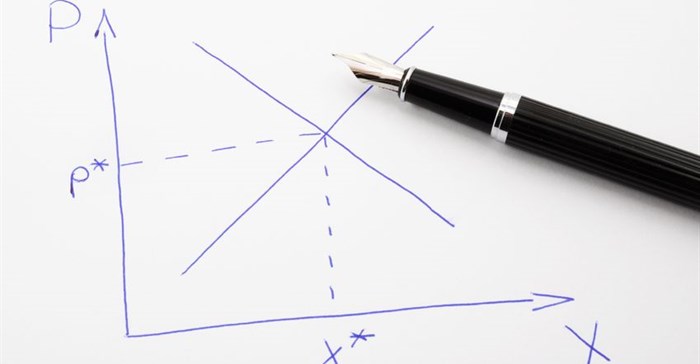

Getting back to basics, Economics 101 literature might present some answers. The supply-and-demand curve is probably the most fundamental and, in my work in Africa, I have experienced the need for companies properly to research both the market supply and market demand sides of their businesses across many different markets and product types.

In Tanzania, for example, a large retailer built a big destination store, expecting people to flock in from all over the city to buy their goods. What they realised, months after opening, was that consumers would choose to purchase goods conveniently from markets within walking distance from their homes, even if it meant paying slightly more.

There are some well-known examples in Nigeria of South African companies that have got the supply of goods right and those that haven’t, showing the fine line between success and failure in African markets. According to an article ‘Shoprite hangs in as Nigeria feels the pinch’ in the Sunday Times - Business Times on 28 February, 2016, Woolworths pulled out of Nigeria in 2013 due to high rental costs and duties and a complex supply chain. The article states: “Reflecting on the difficulties in operating in Nigeria, Woolworths CEO Ian Moir said recently: ‘Nigeria is a really tough market and we were having real difficulty getting the flow of goods right.’”

Companies such as Shoprite, which has survived and even thrived under difficult economic times in Nigeria, managed to build a fluid and sustainable supply chain to achieve success. To get around the challenges posed by red tape on imports, Shoprite built the local market, sourcing 76% of its products from local suppliers, according to CEO Whitey Basson, as quoted in the article mentioned above.

Another example of the supply chain effect cited in an article ‘Global pedigree counts in Africa’s biggest market’ in the Sunday Times - Business Times on 28 February, 2016 was Tigerbrands, whose Dangote Flour Mills initiative failed after two years, “The company's former CEO, Peter Matlare, admits management's failings: ‘I think we got some things wrong as a management team, certainly on the go-to-market side of that business. We certainly didn't have the right models operating in that business."

This is all evidence that creating the demand for goods, no matter how effective, may not result in sales for other reasons, such as those mentioned above. Africa presents a complex landscape and each region needs to be carefully researched and understood before entering a market.

One of the most innovative and successful approaches is to map the supply-and-demand cycle in its entirety and identify where current or potential blockages exist. As one company that supplies health products in Mozambique found out, the ‘last mile’ from retailer to consumer was the most critical and by deploying agents to work this zone they were able to boost sales significantly.

To a large extent, a more holistic and business-focussed approach to market research certainly uncovers the business intelligence that informs decisions for measurable improvement by unblocking inefficiencies and at the same time realising opportunities for growth.