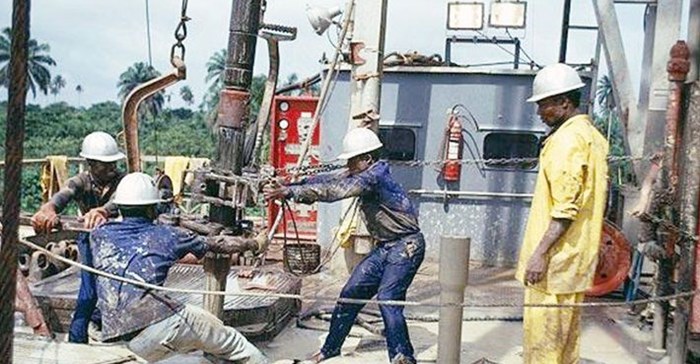

In 2003, Nigeria had a bid round for its marginal field with 24 licenses awarded to 31 companies, some as sole operators and others as joint-ventures. The offer opened a number of opportunities to local and regional industry players while it contributed to increase the country’s oil output and promoted indigenous participation in petroleum upstream activities.

For companies like Oando, Waltersmith, Shoreline Energy, Seplat, Sahara Petroleum or Brittania-U, these fields represented important opportunities to farm-out some acreage from the majors and lead their own projects. While some developments have been slower than expected, the outcome of the process was mostly successful. Today, around a third of the licenses issued produce meaningful amounts of crude oil.

However, there are a couple of lessons to be learned from the Nigerian experience. Firstly, marginal fields are particularly attractive for smaller indigenous or regional companies that can operate well with smaller profit margins. These companies are also much more cash-strapped than the likes of ExxonMobil or Total and therefore need investment capital to develop their acreage.

The Nigerian experience tells us that seeking capital in the local financial sector can be challenging. Nigerian banks have been resistant to awarding credit lines to small operators in this kind of project. Normally, banks issue loans against equity or assets used as collateral. These oil operators’ attempt to use the oil reserves as collateral hasn’t been well accepted by the Nigerian financiers, and that has delayed field development. This means that inviting foreign partners with access to capital becomes paramount.

Secondly, there is the issue of legal clarity. The Nigerian Petroleum Industry Bill, which in its many forms has been under discussion for over two decades, continues to create disruption and uncertainty in the industry and delaying new bidding rounds. If the current form of the bill is approved, marginal field operators are expected to receive significant cuts in the taxes and royalties, but that remains unclear for the time being.

APO is the sole press release wire in Africa, and the global leader in media relations related to Africa. With headquarters in Dakar, Senegal, APO owns a media database of over 150,000 contacts and the main Africa-related news online community.

Go to: www.bizcommunity.com/PressOffice.aspx?cn=apogroup